Russian Lawmakers Advance Bill For Crypto Seizures In New Regulatory Push

Alex Smith

2 weeks ago

Russian lawmakers have moved forward with legislation that will formally allow the regulation of crypto asset seizures in criminal proceedings, eliminating legal vacuums that complicated previous investigations.

Crypto Seizure Bill Advances At State Duma Committee

On Monday, the Committee on State Building and Legislation at the State Duma, the lower house of the Federal Assembly of Russia, advanced a bill to regulate the seizure of crypto assets in criminal proceedings.

In an official Telegram message, the ruling political party in Russia, the All-Russian Political Party United Russia, revealed that the legislation was recommended for adoption in its upcoming third reading.

Although cryptocurrencies are already recognized as property under several laws, their status has not yet been established in criminal procedure laws, the statement noted, which has complicated the investigation of crimes and the enforcement of property claims.

As a result, the recently passed crypto bill is designed to reduce the risks associated with the use of cryptocurrencies in criminal activities, such as money laundering, corruption, and terrorist financing.

To address this, the bill proposes recognizing digital assets as property under the Criminal Code and the Code of Criminal Procedure of the Russian Federation. In addition, it intends to amend the Code of Criminal Procedure with a new article to regulate the actions of investigators upon discovering digital assets subject to seizure.

The legislation will also grant relevant authorities investigating a case the power to seize assets by taking control of physical devices, including servers, computers, and cold wallets, or by transferring the assets to a special address to ensure their preservation. Lastly, it will introduce a mechanism for freezing digital currency for subsequent confiscation or to secure a civil claim.

“The adoption of the law will eliminate the legal vacuum and create effective mechanisms for law enforcement agencies to work with modern digital assets, based on international recommendations and the successful experience of foreign legal systems,” said Pavel Krasheninnikov, head of the State Duma Committee on State Building and Legislation.

Russia Prepares For New Regulatory Landscape

If approved, the bill would complement Russia’s upcoming crypto framework, which is expected to take effect by July. In December, the Central Bank of Russia unveiled new comprehensive regulatory proposals to enable retail and qualified investors to buy digital assets through licensed platforms in the country.

The new rules will allow non-qualified investors to purchase up to 300,000 rubles annually in the most liquid cryptocurrencies after passing a knowledge test. Moreover, qualified investors will be able to buy unlimited amounts of any digital asset after passing a risk-awareness test.

Under the proposed framework, transactions must be conducted through platforms that are already licensed, including exchanges, brokers, and trust managers, with additional requirements applied to custodians and exchange services.

Additionally, residents will be allowed to buy crypto assets abroad and transfer their holdings through Russian-licensed intermediaries, subject to the necessary tax reporting. Leading stock exchanges, the Moscow Exchange (MOEX) and SPB Exchange, have shared their support for the central bank’s proposed regulatory framework.

As reported by Bitcoinist, the institutions confirmed they are prepared to launch crypto trading services under the upcoming rules as soon as they are enacted. The Moscow Exchange affirmed that it is actively working on solutions to serve the cryptocurrency market, with plans to offer them as soon as the relevant regulations are in place.

Meanwhile, the SPB Exchange also stated that it is prepared to participate in joint efforts to develop the relevant infrastructure within the regulated market, highlighting the Central Bank’s efforts to create “transparent and secure conditions” for crypto trading.

Related Articles

Crypto Lender Nexo Returns To US Market After Three-Year Hiatus And $45 Million Fine

Crypto lender Nexo has officially reentered the United States market, marking a...

Former White House Crypto Adviser Confident CLARITY Act Will Pass As Deadline Nears

A former White House crypto adviser has shared his thoughts on the delay of the...

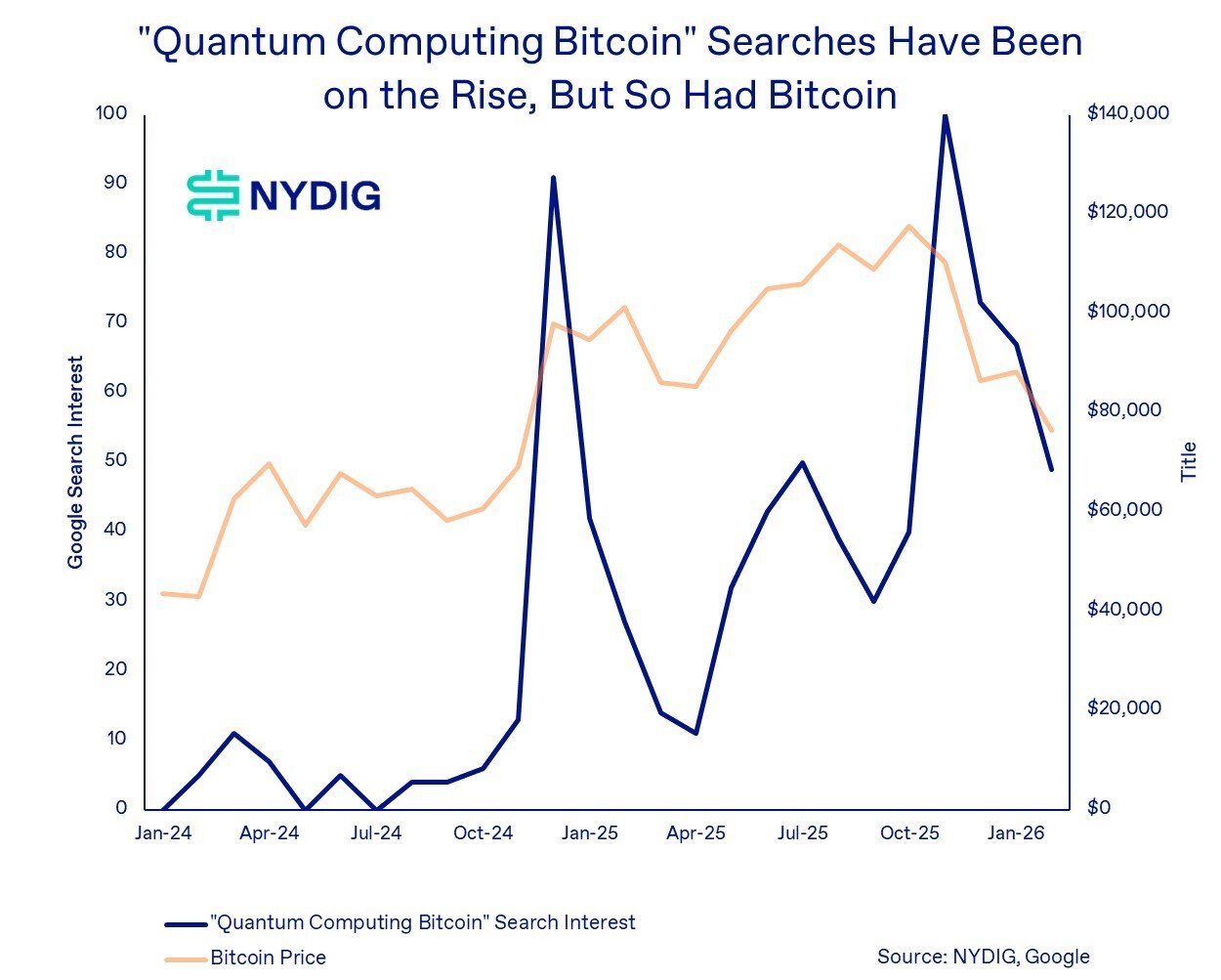

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...