Former White House Crypto Adviser Confident CLARITY Act Will Pass As Deadline Nears

Alex Smith

3 hours ago

A former White House crypto adviser has shared his thoughts on the delay of the long-awaited market structure bill and whether the banking and digital assets industry will resolve their differences soon.

Bo Hines Optimistic About Crypto Legislation

On Monday, Bo Hines, CEO of Tether US and former executive director of the US President’s Council of Advisors for Digital Assets, expressed optimism about the passage of the crypto market structure bill, known as the CLARITY Act.

In a recent interview with journalist Eleanor Terret at the Digital Assets at Duke Conference, Hines affirmed that he’s “actually confident that CALRITY will get passed” despite the delay.

It’s worth noting that the highly anticipated legislation has been stalled after hitting a roadblock a month ago due to restrictions on the payment of stablecoin yield, meant to address the banking industry’s concerns of deposit flight risk.

The crypto industry heavily criticized the Senate Banking Committee’s policy, leading to the delay of the mid-January markup session and an extended negotiation process between lawmakers and leaders from both industries.

Now, time seems to be running out, Terret noted, as we approach the alleged White House’s end-of-month deadline for the crypto and banking industries to solve the stablecoin yield dispute.

Due to this, Hines affirmed that both sides “are in the pressure cooker right now,” arguing that the two industries understand they must make concessions to reach an agreement and advance the bill.

As reported by Bitcoinist, the digital assets industry has already proposed some compromises to salvage the crypto legislation, such as giving community banks a larger role in the stablecoin system.

The former White House adviser highlighted the Office of the Comptroller of the Currency’s (OCC) recent moves. Notably, the OCC has started to issue conditional licenses to more digital assets native companies, which he considers will provide a pathway to “find a resolution that (…) protects banks from deposit flight, but also allows these crypto companies to be innovative and offer different solutions to their customers.”

CLARITY Act’s Window ‘Rapidly Closing’

Hines also noted that the crypto industry is aware that they must take advantage of the legislative momentum, “especially under this administration that’s been extremely pro- digital assets.”

As he explained, “this is where you’re going to get the best return on investment in a sense of like what you’ve been doing over the course of (…) the last few years in terms of political activity and engagement.”

Similarly, Patrick Witt, the current executive director of the US President’s Crypto Council, shared a similar perspective on Friday. The advisor affirmed that they are “working hard to address the issues that were raised that led to the postponement of that markup and hopefully get that back on the books soon.”

Nonetheless, he urged lawmakers to keep the momentum going, emphasizing that the window to pass the legislation is still open, but it is “rapidly closing” as the midterm election campaign season approaches, which “takes all the oxygen out of the room.”

The US Secretary of the Treasury Scott Bessent also pressed lawmakers to advance the bill soon, highlighting the importance of getting the legislation on President Donald Trump’s desk before the end of the spring legislative window.

Bessent stressed that the chances of getting a deal done could collapse if Democrats take control in November, recalling the crackdown on the industry during the Biden administration.

“There’s a lot of innovation that goes on adjacent to crypto, the blockchain, and DeFi. So, I think it’s important to get this clarity bill done as soon as possible and on the president’s desk this spring,” he declared on Friday.

Related Articles

Crypto Lender Nexo Returns To US Market After Three-Year Hiatus And $45 Million Fine

Crypto lender Nexo has officially reentered the United States market, marking a...

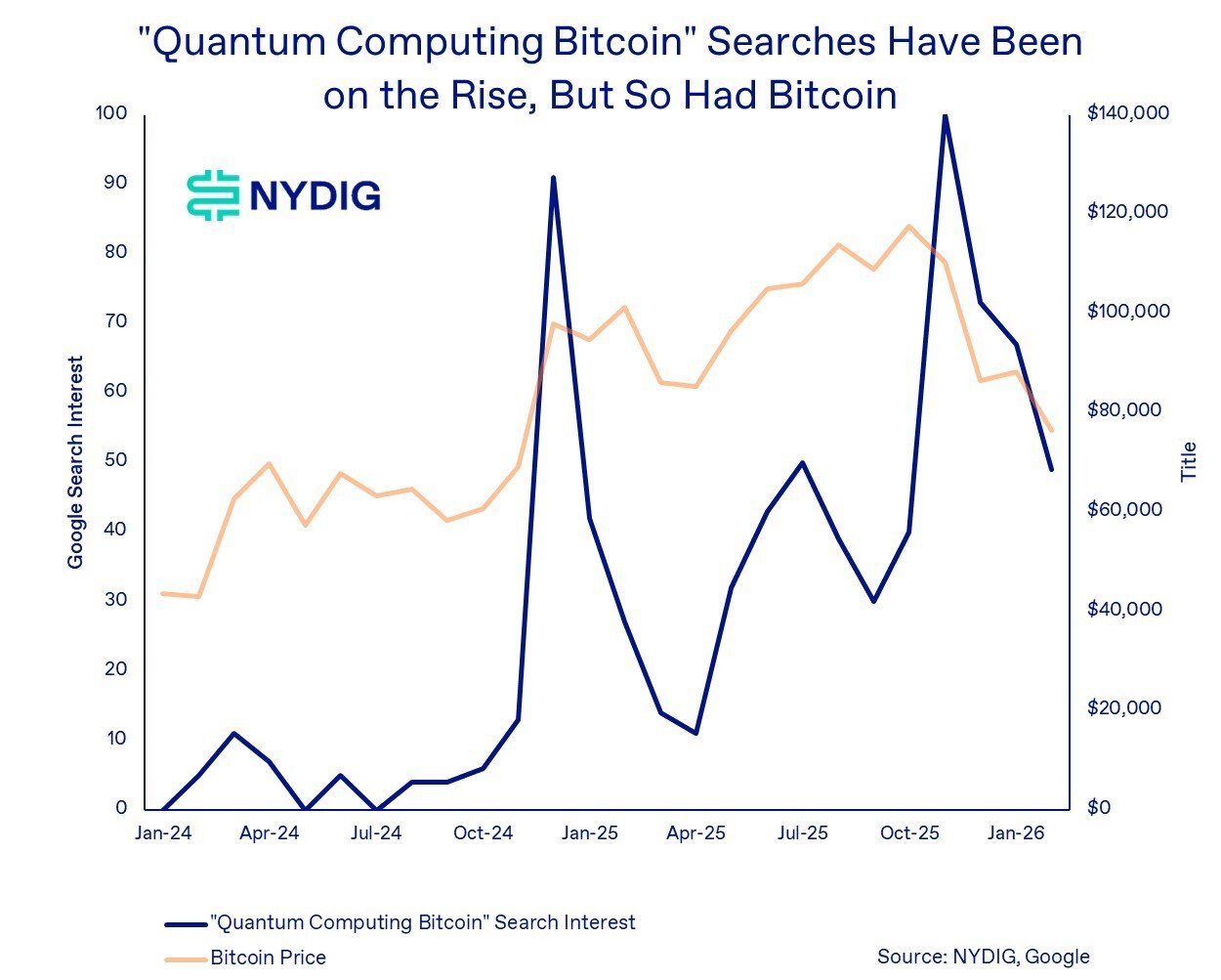

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...

Crypto Watchlist: The Key Catalysts To Track This Week

Crypto’s week is stacked: ETHDenver pulls builders into Denver, a major DAO vote...