Prediction Markets On BNB Chain Explode As Trading Volume Crosses $20B

Alex Smith

2 weeks ago

Prediction markets on the BNB Chain have seen massive growth over the past months, with the leading platforms within the ecosystem reaching remarkable levels and their cumulative trading volume hitting a new milestone.

BNB Chain Sees Prediction Markets Explosion

On Monday, BNB Chain announced that prediction markets in the ecosystem reached a new milestone, surpassing the $20.91 billion mark in cumulative trading volume over the weekend.

Notably, the BNB Chain has expanded its presence over the past few months, diversifying with key players such as Opinion Labs, Probable, Myriad Markets, Predict.Fun, and XO Markets.

Prediction markets are one of the most popular ways to forecast events and manage risk at scale, the BNB Chain explained in a blog post, becoming “powerful tools for smarter decisions in finance, governance, and beyond.”

“From elections and sports to AI milestones and macroeconomic shifts, prediction markets transform scattered knowledge into actionable signals. Platforms like Polymarket, which saw over $2B in volume in October 2024, prove that decentralized markets can even outperform centralized forecasters,” they added.

According to Dune data, prediction markets within the ecosystem have seen a significant surge since Q4, increasing nearly 89% just in the past month. The data also shows that BNB Chain has taken the lead in weekly trading volume by chain, surpassing off-chain prediction markets, Polygon, Solana, and Base since the start of 2026.

Moreover, DeFiLlama data indicate that three platforms in the BNB ecosystem are currently among the top 5 prediction markets, only behind Kalshi and Polymarket, signaling increasing adoption.

Opinion Labs ranks third in the list, with its 7-day and 30-day trading volumes reaching $725.56 million and $3.35 billion, respectively. Meanwhile, its open interest exceeded $144 million as of late January.

Probable has seen $558 million in volume over the past 7 days and $1.05 billion in the last 30 days. The platform has also reached a $1.4 billion in notional volume and over 17,000 users just a month after its launch.

ETF Push And Price Recovery

The recent milestone comes as major institutional players share interest in the BNB token. Last week, Grayscale filed an S-1 form with the US Securities and Exchange Commission (SEC) to launch a spot Exchange-Traded Fund (ETF) based on the cryptocurrency.

If approved, the Grayscale BNB Trust (GBNB) will “reflect the value of BNB held by the Trust, including BNB earned as Staking Consideration” and offer investors exposure to the token without having to hold it directly.

As of this writing, BNB’s price has recovered from Sunday’s correction and is attempting to turn a key area back into support. Market observer Rose Premium Signals highlighted that the cryptocurrency bounced from the strong $860 demand zone after the sharp corrective move.

Moreover, it held the key Fibonacci retracement area, “which increases the probability of a bullish reaction.” If the altcoin successfully reclaims the $900 area as support, the analyst suggested that a retest of the $937 and $980 targets could follow.

Related Articles

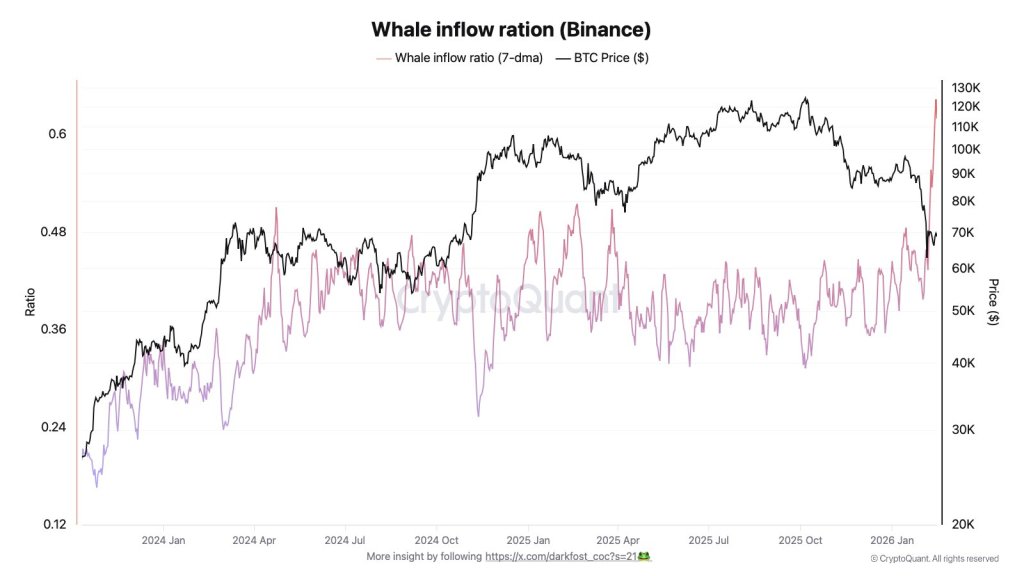

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...

XRP $100 Thesis: Jake Claver Details What Must Happen

Jake Claver is again laying out the conditions he says must line up for XRP to r...

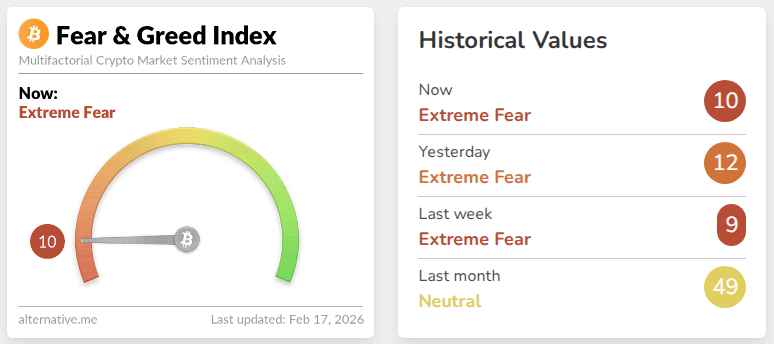

After Extreme Pessimism, Crypto Market Conditions Begin To Stabilize: Analysts

Crypto markets are leaning toward their quietest mood in years, and some analyst...