XRP $100 Thesis: Jake Claver Details What Must Happen

Alex Smith

2 hours ago

Jake Claver is again laying out the conditions he says must line up for XRP to reach triple digits, framing the bet not as a chart call but as a sequencing problem tied to institutional tokenization, on-chain liquidity, and regulated market plumbing. In a “Memes and Markets” interview on Feb. 16 with Ben Leavitt and Keith D, Claver defended his so-called “Domino Theory”.

Claver told the hosts he didn’t enter crypto until 2020, built a broader portfolio first, then consolidated into XRP after the 2022 drawdown because he viewed it as the “for sure thing.” The hosts pushed on his habit of speaking in absolutes, with Leavitt describing it as “the scariest thing” given how widely his clips circulate. Claver didn’t retreat from the posture.

“I will put my nuts on the line and make statements,” he said, adding that his attorneys have advised him to refrain from doing so going forward. “I’m not going to back down. I have a very strong belief in this. And I’ve had enough validation from the right people that lead me to believe that this is the outcome that will take place.”

From there, the conversation moved into what Claver sees as the social base of the XRP trade. He argued that XRP attracts a “consistent type of person,” describing holders as disproportionately “faith-based,” generally older, and oriented toward family wealth and philanthropy rather than maximalist anti-bank narratives.

Why XRP Could Reach $100

In his telling, that demographic preference is inseparable from the asset’s positioning. “They don’t think the banks are going to go away. They’re not going to be disintermediated,” Claver said. “They don’t think that this is going to be a free DeFi ecosystem, free for all where people can participate without compliance and oversight. And so XRP being the banker’s coin, right? Like that’s appealing to them.”

Claver’s core mechanism is less about a single catalyst and more about preconditions. He pointed to timelines he says were aired by large financial institutions around tokenizing asset classes “in the next two years, by the end of 2028,” arguing that tokenization doesn’t matter without the ability to transact at scale.

“It really doesn’t provide additional value today because there’s not enough liquidity in those ecosystems for people to transact like there is on the stock market or other markets,” he said. In his model, custody, identity, and liquidity are gating items; once those are in place, stablecoins could be issued on XRPL with XRP used as an intermediary asset, enabling marketplaces for tokenized stocks, private markets, and real estate to function “in a regulated environment.”

He also offered a cultural feedback loop: a long-running belief in “very high price” outcomes encourages holders to sit tight, reducing the tradable float. In Claver’s view, that scarcity (100 billion token supply) dynamic can amplify price pressure if demand arrives alongside institutional rails. “The more that gets taken off the market, the scarcer the supply is that’s openly traded and the higher the price will get pushed,” he said, arguing that many won’t sell “until they see the significantly higher prices that many people are hoping for.”

The interview didn’t avoid the blowback from Claver’s missed New Year’s call. He said his conviction was partly tied to NDAs and partly to a public bet whose purpose, he claimed, was to ensure retail participants weren’t permanently stripped of XRP in side wagers. “Some people like to grind hard for the amount of XRP that they have,” he said. “And for them to just lose that to somebody else on a bet on Twitter, I didn’t feel good about. So all of those people have been returned their XRP.”

Pressed on the risk that followers made “very poor financial decisions” around his timeline, Claver leaned on disclaimers and a wealth-management argument: big gains can be destabilizing without tax planning, estate structure, and stewardship. He noted that his advisory firm’s regulated advisors “would tell me I am being reckless and irresponsible with how I have made my allocation,” positioning his own posture as personal choice rather than template.

At press time, XRP traded at $1.47.

Related Articles

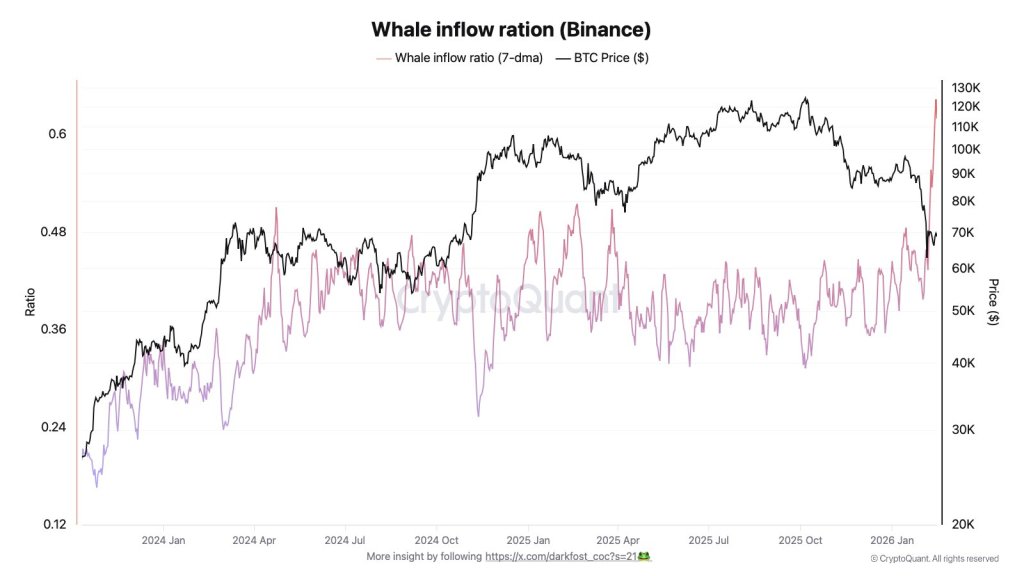

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...

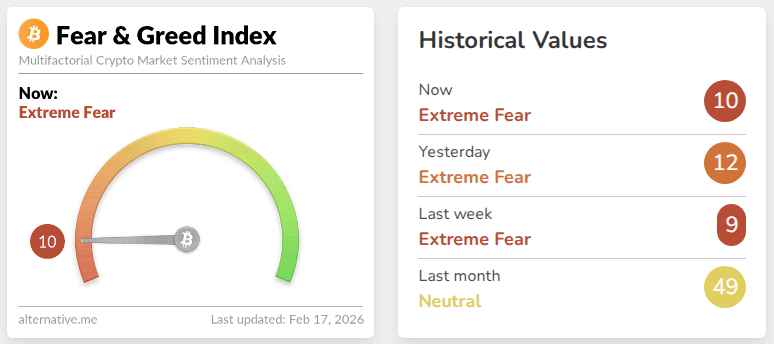

After Extreme Pessimism, Crypto Market Conditions Begin To Stabilize: Analysts

Crypto markets are leaning toward their quietest mood in years, and some analyst...

Top Expert Projects Bitcoin Bear Market To End In Less Than 365 Days

With Bitcoin (BTC) hovering around 50% below its all-time high of $126,000 reach...