Ethereum Holders Jump 3% In January, Clear 175 Million Milestone

Alex Smith

2 weeks ago

On-chain data shows non-empty addresses on the Ethereum network have set a new record of 175.5 million, the highest among all digital assets.

Ethereum Has Seen A New Record In Total Amount Of Holders

According to data from on-chain analytics firm Santiment, the Total Amount of Holders has hit a new milestone for Ethereum recently. This indicator tracks the total number of wallets on the network carrying a non-zero balance. When the value of this metric rises, it means new users are joining the network, and/or old users who had sold earlier are investing back into the asset.

The trend can also arise due to existing users distributing their holdings across multiple wallets. In general, all three of these can be assumed to simultaneously be at play to some degree, meaning that whenever the Total Amount of Holders goes up, some net adoption of the network is taking place.

On the other hand, the indicator witnessing a decline suggests some investors are clearing out their wallets, potentially because they have decided to exit from the cryptocurrency.

Now, here is the chart shared by Santiment that shows the trend in the Ethereum Total Amount of Holders over the last few months:

As displayed in the above graph, the Ethereum Total Amount of Holders was rising during the second half of 2025, but since mid-December, growth in the indicator has gone up a gear. In January alone, 5.16 million more addresses have joined the network, representing a jump of 3.03%. The metric’s value is now at 175.5 million, a new all-time high for ETH and a record among all digital assets.

Growth in the Total Amount of Holders isn’t the only on-chain development that Ethereum has observed recently. In the same chart, the analytics firm has also attached the data for another indicator: the Supply on Exchanges. This metric measures the total amount of ETH that’s currently sitting in wallets associated with centralized exchanges.

From the graph, it’s visible that the Ethereum Supply on Exchanges has continued to go down, a sign that investors have been taking their Ethereum off these platforms. The push toward exchange withdrawals has come as staking interest has been rising on the network.

“As staking continues to be of strong interest, especially while markets move sideways, exchange supply will continue to shrink as well,” explained Santiment.

ETH Price

Ethereum has been making its way back up since its Sunday low under $2,800, as the asset’s price is now back above $3,000.

Related Articles

Former White House Crypto Adviser Confident CLARITY Act Will Pass As Deadline Nears

A former White House crypto adviser has shared his thoughts on the delay of the...

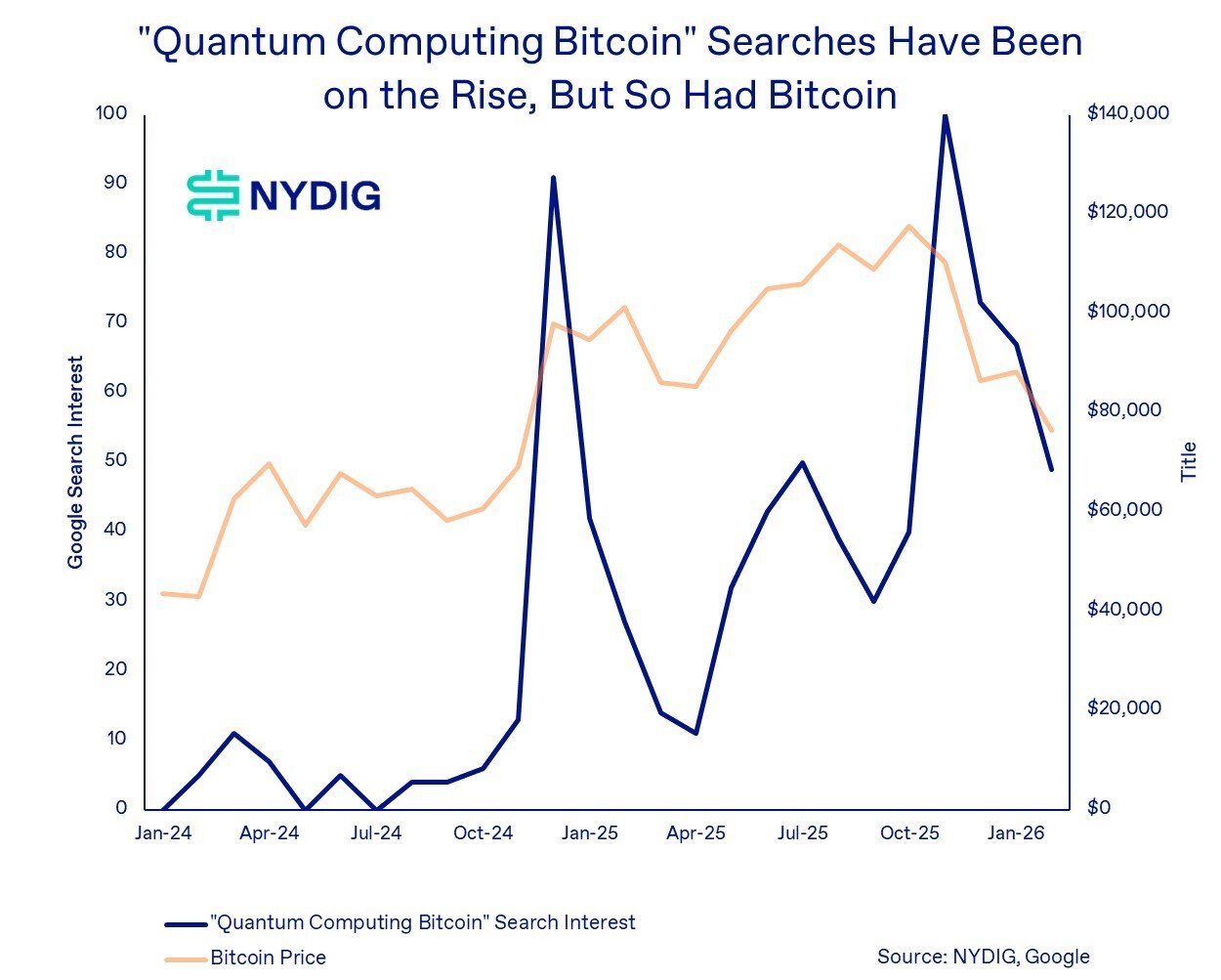

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...

Crypto Watchlist: The Key Catalysts To Track This Week

Crypto’s week is stacked: ETHDenver pulls builders into Denver, a major DAO vote...