Crypto Funds Funneled To Money Launderers Hit $82 Billion, According To Chainalysis

Alex Smith

2 weeks ago

Blockchain analytics firm Chainalysis has released a new report highlighting a sharp escalation in crypto-based money laundering, warning that Chinese-language money laundering networks are emerging as one of the most serious and rapidly growing threats in the digital asset ecosystem.

The Rise of Chinese‑Language Networks In Crypto Crime

According to the report, illicit on‑chain money laundering activity has expanded dramatically over the past five years. In 2020, crypto-related laundering was estimated to be around $10 billion. By 2025, that figure had climbed to more than $82 billion.

A key driver behind this growth has been the rapid rise of Chinese‑language money laundering networks, often referred to as CMLNs. In 2025, these networks accounted for roughly 20% of all identified illicit crypto laundering activity on‑chain.

Chainalysis noted that this regional concentration is further supported by off‑ramping behavior observed on the blockchain. As detailed in the report, CMLNs now routinely launder more than 10% of funds stolen through so‑called “pig butchering” scams.

The pace at which these networks have grown stands out even within the broader crypto crime landscape. Since 2020, inflows to identified CMLNs have increased 7,325 times faster than those to centralized exchanges (CEXs).

Growth has also outstripped other laundering channels, expanding 1,810 times faster than decentralized finance (DeFi) platforms and 2,190 times faster than illicit on‑chain flows that remain within criminal ecosystems.

While CMLNs are not the only actors involved in crypto laundering, Chainalysis found that Chinese‑language, Telegram‑based services now represent a disproportionately large share of attributed global laundering activity.

Cross‑Border Crime At Scale

The report also shows that CMLNs function openly across multiple platforms and rely on complex, multi‑layered systems. Their operations are characterized by industrial‑level processing capacity and a high degree of technical sophistication.

In 2025 alone, Chainalysis identified six distinct service types that together form the CMLN ecosystem. Combined, these services processed $16.1 billion in illicit inflows during the year.

The number of active entities within these networks has also grown rapidly, expanding from a small number of wallets just a few years ago to more than 1,799 active on‑chain wallets in 2025.

Tom Keatinge, Director at the Centre for Finance & Security at the Royal United Services Institute, said the speed and scale of these networks are the result of converging global forces.

He noted that Chinese money laundering networks have rapidly evolved into “multi‑billion‑dollar cross‑border operations” offering efficient and competitively priced services to organized crime groups across Europe and North America.

Chris Urben, Managing Director at Nardello & Co, highlighted another major shift within these networks. He explained that Chinese money laundering groups have increasingly moved away from informal value transfer systems, such as traditional underground banking methods.

Instead, Urben emphasized that these criminals have embraced cryptocurrencies as a “faster and more discreet way” to move funds across borders, eliminating the need for complex manual ledgers spread across multiple jurisdictions.

Featured image from DALL-E, chart from TradingView.com

Related Articles

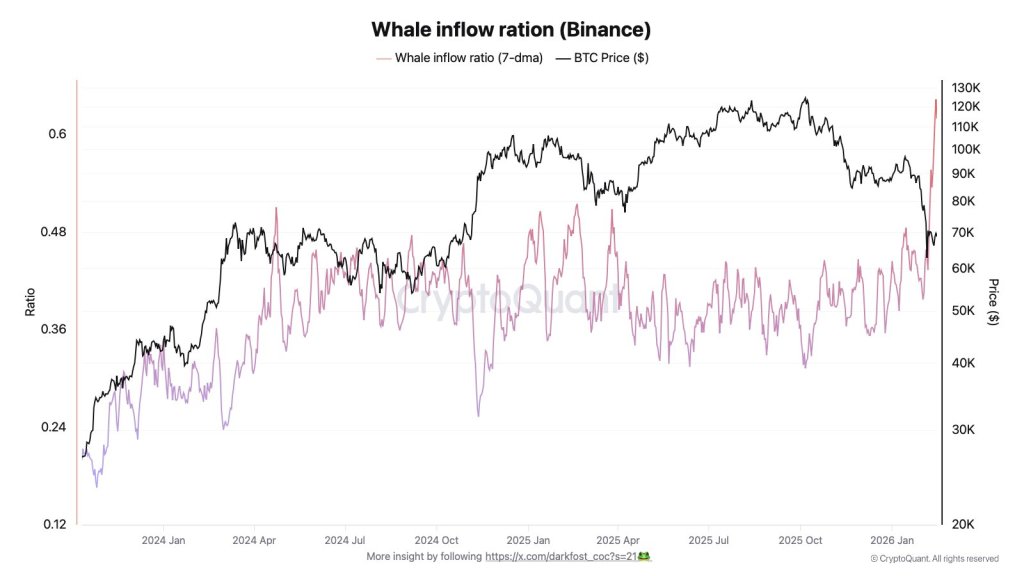

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...

XRP $100 Thesis: Jake Claver Details What Must Happen

Jake Claver is again laying out the conditions he says must line up for XRP to r...

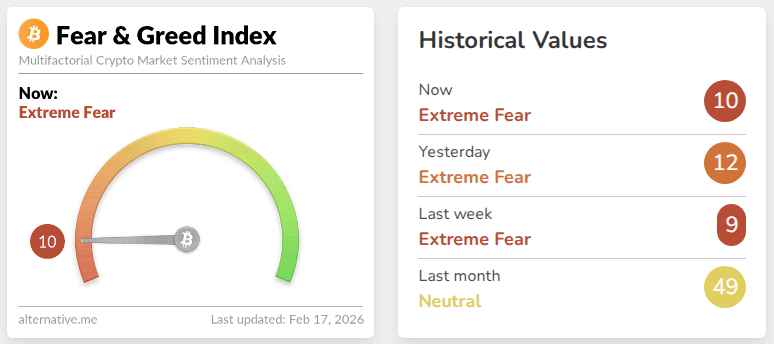

After Extreme Pessimism, Crypto Market Conditions Begin To Stabilize: Analysts

Crypto markets are leaning toward their quietest mood in years, and some analyst...