Bitcoin Price Mirroring Key Patterns From 2021 – Is History About To Repeat?

Alex Smith

3 weeks ago

The Bitcoin price is showing signs of history repeating itself, as current price action mirrors key patterns from the 2021 cluster. With resistance near $91,000–$92,000 and the macro downtrend looming, traders are watching closely to see if BTC will break higher or face renewed pressure. The coming days could prove decisive in shaping the next major move.

Bitcoin Mirrors 2021 Cluster: History In Motion

Bitcoin continues to mirror the price patterns seen during the 2021 cluster. Crypto analyst Rekt Capital noted that the current market structure is echoing historical behavior, suggesting that similar dynamics are at play. Traders are closely watching these familiar patterns to gauge whether the cycle is repeating itself or if new trends may emerge.

The rules of the game remain consistent. A bearish acceleration would likely be triggered if Bitcoin breaks down from the macro descending triangle base, currently positioned around $82,000. Conversely, a bullish bias would require a decisive break above the macro downtrend, which sits near $100,000. These levels serve as critical decision points for the market, dictating whether bulls or bears gain control in the coming sessions.

So far, Bitcoin has encountered rejection in the high $90,000s, falling just short of the macro downtrend. This mirrors previous market behavior, in which the asset developed a basing structure near the triangle’s base before attempting to push higher toward the downtrend’s upper boundary. It demonstrates that history is repeating itself for now, with the market consolidating and preparing for its next directional move.

If the macro downtrend continues to act as resistance, the triangle’s base may gradually weaken over time. Such a development would increase the risk of further downside, making the reaction at both the base and the downtrend crucial.

BTC Surpasses $91,000 Before Facing Selling Pressure

In a recent market update by Ted, it was noted that while Bitcoin broke above the $91,000 threshold yesterday, the rally met significant resistance. Sellers entered the market with substantial force at these local highs, effectively capping the momentum and preventing a sustained breakout.

As a result of this rejection, Bitcoin has retreated into the “no-trading zone.” Ted suggests that this period of sideways price action is likely to persist through the next couple of days, largely driven by the typical low-liquidity environment seen during the weekend.

Looking ahead, the outlook remains cautious. Ted emphasizes that any upward movements will likely be short-lived until BTC can decisively clear the $91,000 to $92,000 resistance zone. Meanwhile, such a move must be backed by strong spot demand to prove its validity.

Related Articles

Dogecoin Has Now Broken Out Of A Descending Triangle, Here’s The Next Stop

Dogecoin might be trading at $0.1, but is already flashing signs of a structural...

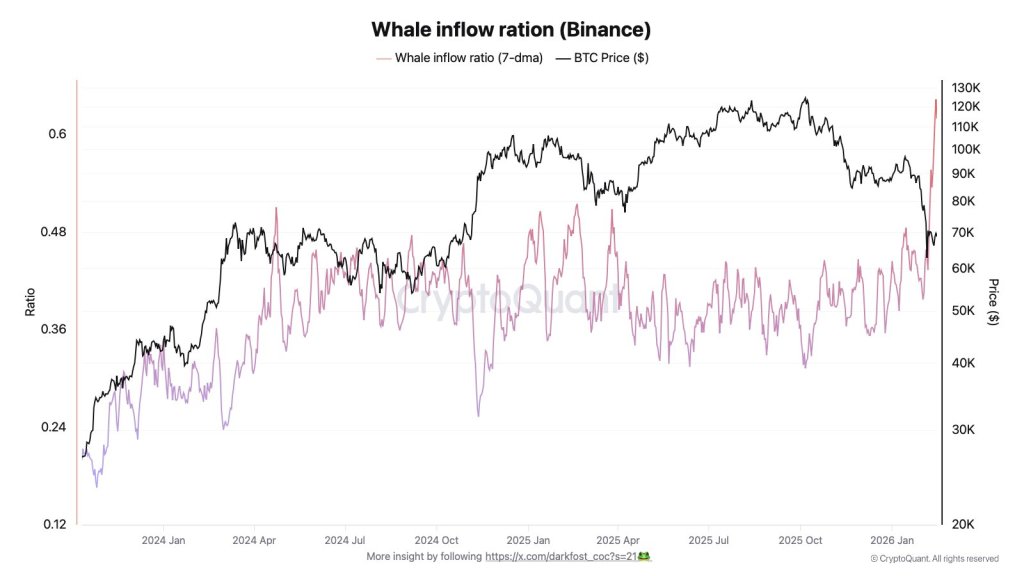

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...

XRP $100 Thesis: Jake Claver Details What Must Happen

Jake Claver is again laying out the conditions he says must line up for XRP to r...