Analyst Says Chainlik Price Could Crash 50% If This Level Fails

Alex Smith

2 weeks ago

Chainlink is approaching a technically sensitive area with a growing downside risk on higher timeframes that was flagged by a crypto analyst. Based on a recent technical analysis on X, the analyst noted that LINK’s current weekly structure leaves the market vulnerable if an important support zone around $10 gives way.

The price action is still holding above that area for now, but the chart shows that a decisive move below it could quickly change the outlook into a bearish mood.

Head And Shoulders Formation On Weekly Timeframe

According to a popular crypto analyst known as CryptoBullet on X, LINK’s weekly chart has carved out a standard head and shoulders formation. Based on the rules of technical analysis, the Head and Shoulders (H&S) pattern is bearish. The pattern resolves bearish when there is a confirmed break below the neckline resistance.

Technical analysis of Chainlink’s price action shows the left shoulder formed during the early stages of the 2024 recovery, followed by a higher peak that marked the head in early 2025. This was then followed by another lower high that completed the right shoulder in the second half of 2025.

However, the most important zone to watch is the neckline support, which slopes slightly upward and is currently sitting in the $10 to $11 region. This support zone has acted as structural support during multiple pullbacks while the head and shoulders pattern was taking shape, making it the most important level to watch going forward. As long as the price holds above it, then the pattern is unconfirmed.

ChainLink Price Chart. Source: @CryptoBullet1 on X

Losing Support Level And Price Targets

The analyst cautioned that a decisive weekly close below the neckline would activate the bearish setup. In technical analysis, a confirmed head and shoulders breakdown is known to open the path to a measured move equal to the height of the pattern.

Applied here, that projection places LINK’s downside target in the $4 to $5 range, which would represent just about a 50% decline from current price levels. CryptoBullet described this outcome as the lowest area LINK could reach this year if there’s strong selling pressure, and that such a move would only come into play if support fails very quickly.

Notably, the analysis also pointed to an intermediate level that could act as a stopping point that might stop LINK from crashing to $4. A more conservative downside target is around $7.15, which is connected with the Point of Control on the Volume Range Visible Profile and overlaps with the 2022 to 2023 accumulation zone that’s shown on the chart above.

At the time of writing, LINK is trading at $11.98, up by 1.1% in the past 24 hours but down by 5.4% in a seven-day timeframe. A rebound from the neckline area would shift the short-term outlook to a relief bounce.

Related Articles

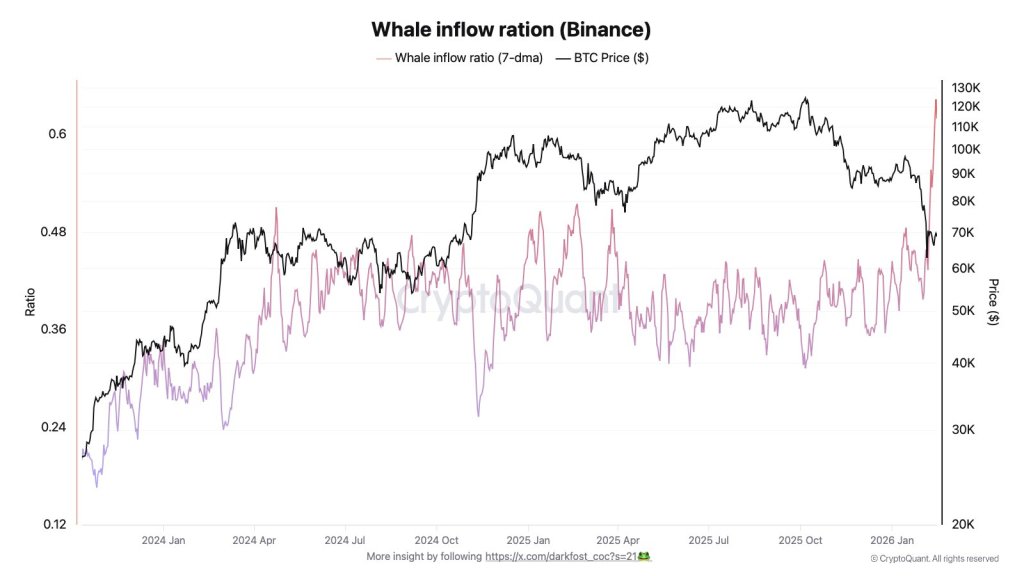

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...

XRP $100 Thesis: Jake Claver Details What Must Happen

Jake Claver is again laying out the conditions he says must line up for XRP to r...

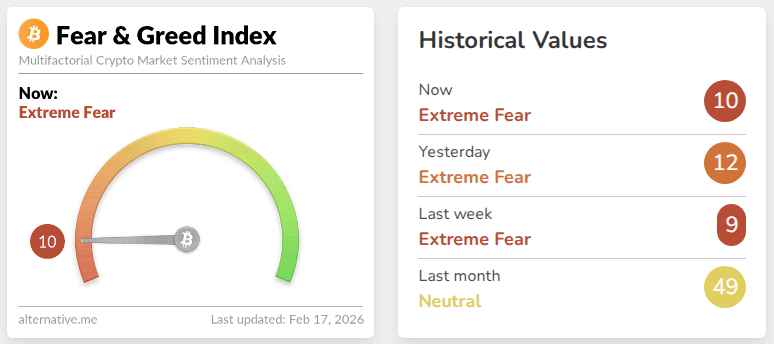

After Extreme Pessimism, Crypto Market Conditions Begin To Stabilize: Analysts

Crypto markets are leaning toward their quietest mood in years, and some analyst...