Why Is Bitcoin And Crypto Down Today? Key Drivers Behind The Move

Alex Smith

4 weeks ago

Bitcoin slid to $91,920 late Sunday in New York, down 3.8% from roughly $95,500, as a sharp risk-off impulse hit crypto markets and quickly bled into high beta majors. Ether fell as much as 5.3% to $3,177, while XRP and Solana underperformed with drawdowns of 10.4% to $1.847 and 9% to $130, respectively, as leveraged positioning was forced out.

Why Is Bitcoin And Crypto Down Today?

The immediate catalyst was a geopolitics-to-trade headline that landed into a weekend liquidity window: President Donald Trump said the US would impose additional 10% tariffs on imports from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland starting Feb. 1, escalating to 25% on June 1 unless a deal is reached for the US to acquire Greenland.

European officials framed the move as coercive and signaled a coordinated response. Dutch Foreign Minister David van Weel called the threat “blackmail,” adding: “It’s not necessary. It doesn’t help the alliance (NATO).” The targeted countries, many of them NATO allies, issued a stark pushback warning that tariff threats “undermine transatlantic relations and risk a dangerous downward spiral,” while EU representatives convened emergency talks over potential retaliation. France’s President Macron threatened EU’s “anti-coercion instrument.”

BREAKING: France’s President Macron calls for the EU to activate its “most potent trade weapon” against the US after President Trump’s tariff threat over Greenland.

Macron is now calling for the use of the EU’s “anti-coercion instrument.”

If used against the US, it would… pic.twitter.com/E47Bpe03lK

— The Kobeissi Letter (@KobeissiLetter) January 18, 2026

For Bitcoin and the entire crypto market, the significance isn’t the tariff math in isolation; it’s the abrupt repricing of global growth and policy risk. When macro traders de-risk into headlines like this, liquid markets tend to transmit the shock first and crypto, with its 24/7 structure and deep derivatives footprint, often becomes the pressure valve.

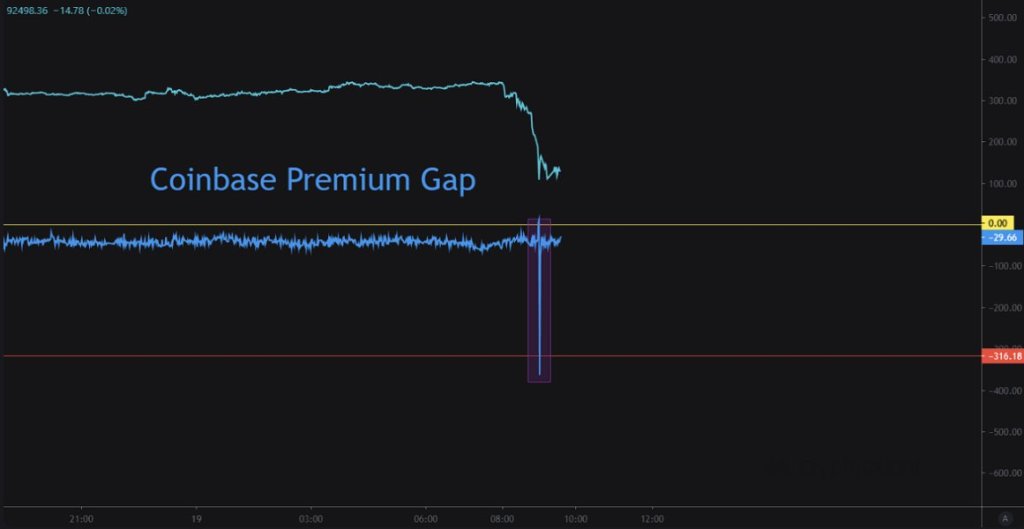

On-chain and venue-level indicators suggested the sell pressure was not simply offshore flow. CryptoQuant analyst Mignolet pointed to an elevated “CPG” (Coinbase Premium Gap), a metric tracking the price differential between Coinbase’s USD market and Binance’s USDT market that is often read as a proxy for US-led demand or supply.

“We’re seeing the strongest selling premium (CPG) in recent periods. Since the ETF market was not open at the time, this selling pressure is coming from US whales operating outside of ETFs. It’s one of the traditional selling patterns we’ve seen repeatedly in the past,” Mignolet wrote in a CryptoQuant note.

That framing matters because it implies the move wasn’t driven by ETF creations/redemptions, so the marginal seller was active in spot/OTC and derivatives channels that remain open through the weekend.

Once spot price slipped through key levels, futures mechanics did the rest. Coinglass data showed 249.422 traders were liquidated, the total liquidations coming in at $874.93 million over the past 24 hours. Longs accounted for $787.92 million versus $87.01 million in shorts, an asymmetric wipeout that typically reflects crowded long exposure being force-closed into falling prices.

At press time, Bitcoin recovered to $93,000.

Related Articles

Ethereum’s Bounce Still Lacks Conviction — Downside Risk Remains

Ethereum is attempting to rebound after recent selling pressure, but the recover...

Analyst Predicts XRP Price Will Reach $13 In 3 Months As Accumulation Ends

XRP might be trading well below the $2 price level, but this hasn’t stoppe...

Solana ETFs Attract $31M While Crypto Funds Lose $173M, Is SOL Gearing for a Possible Rally

While digital asset funds recorded significant capital outflows for a fourth con...

This Ethereum Hidden Bull Divergence Says Price Will Rise Over 100% To Break $4,900 ATH

Crypto analyst Javon Marks has revealed how Ethereum could recover and possibly...