SUI Eyes Price Recovery As Institutional Exposure Expands With Grayscale, Canary ETF Launches

Alex Smith

3 hours ago

As the first two spot SUI exchange-traded funds (ETFs) debut in the US, some analysts have suggested that the cryptocurrency could be preparing for a massive recovery after bouncing from a crucial support level.

SUI’s Institutional Momentum Expands

On Wednesday, Grayscale and Canary Capital debuted the first two spot SUI ETFs, offering direct, regulated exposure to the cryptocurrency while allowing investors to benefit from staking rewards.

Notably, Grayscale expanded its lineup of crypto-based products by converting its Grayscale SUI Trust into a spot ETF, which is now live on NYSE Arca under the GSUI ticker.

According to the announcement, the fund is designed to “provide investors with exposure to SUI and its staking activity through an ETP, offering a convenient way to gain exposure to a network designed for scalable, real-world applications, and the next generation of digital experiences.”

Krista Lynch, Senior Vice President, ETF Capital Markets, at Grayscale, affirmed that “GSUI’s launch on NYSE Arca marks an important milestone in expanding the range of exchange-traded products tied to the Sui ecosystem, including exposure to potential staking rewards.”

Meanwhile, Canary Capital launched the first US spot ETF for the cryptocurrency on Nasdaq under the SUIS ticker. The Canary Capital Staked SUI ETF “brings that exposure into a regulated, exchange-traded structure, providing investors access to SUI and its staking reward potential,” stated Steven McClurg, CEO at Canary Capital.

“Canary continues to deliver on its strategy to translate emerging blockchain networks into accessible, exchange-traded investment vehicles, and we’re pleased to add SUIS in the category,” he continued.

The Sui Foundation highlighted that the latest launches added to a series of institutional milestones in the ecosystem, including multiple Sui-linked investment products and strategic initiatives from firms like 21Shares, Bitwise, and Franklin Templeton.

SUI Preparing For Major Price Recovery?

Amid the spot ETFs’ debut, SUI’s price continued its sideways movement under the $1.00 barrier, trading between $0.93 and $0.98 throughout the day. Ali Martinez suggested that the cryptocurrency could be preparing for a move to higher levels, noting it recently retested a key support level.

As Martinex explained, SUI tested and bounced from a two-year rising support line after the early February market crash. This ascending trendline has previously triggered major rallies.

According to the chart, the last two times the cryptocurrency hit this support line, it jumped 365% and 850% rallied respectively, with the latest sending its price toward its $5.35 all-time high (ATH) in the following months.

To the analyst, if SUI holds the $0.80 area, “history suggests upside could follow. And this time, fundamentals are lining up too.” He pointed out that the growing institutional exposure and the technical structure alignment could set up a base “for something much bigger.”

Similarly, market observer Bitcoinsensus highlighted SUI’s macro structure, which signals a potential leg up toward new highs. Per the post, the altcoin “has been moving up in a very technical structure” since its launch, repeating a 5-wave up followed by a 3-wave correction.

The chart shows that the price is likely near the end of the C-wave of its corrective move, suggesting a new impulsive 5-wave structure could develop in the coming months. “If this trend continues, we could see SUI reach prices above 10$ per coin,” the analyst concluded.

Related Articles

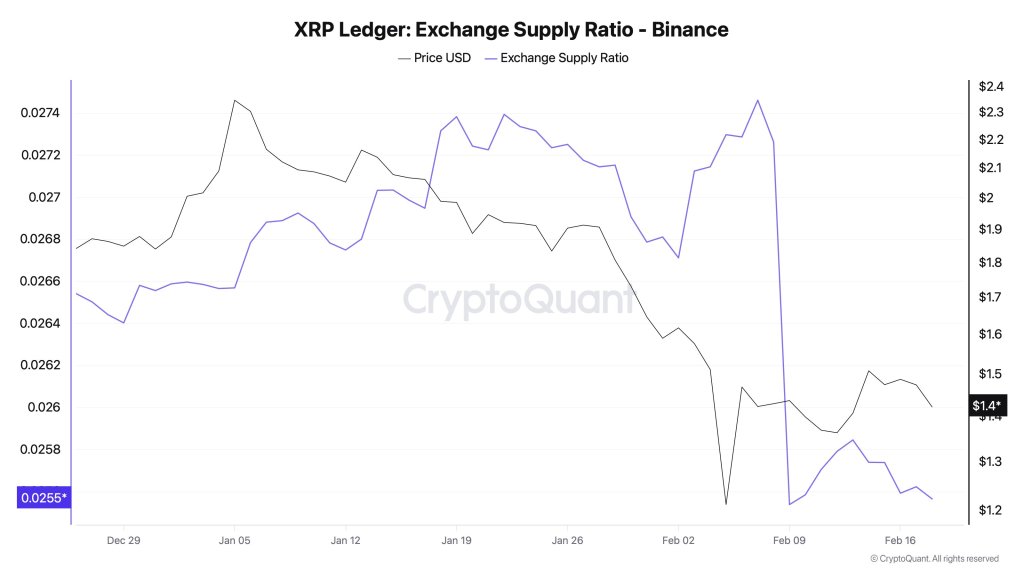

XRP Is Vanishing From Exchanges: Supply Ratio Drop Hints At A New Bid

XRP is quietly leaving Binance at a pace that’s beginning to register in CryptoQ...

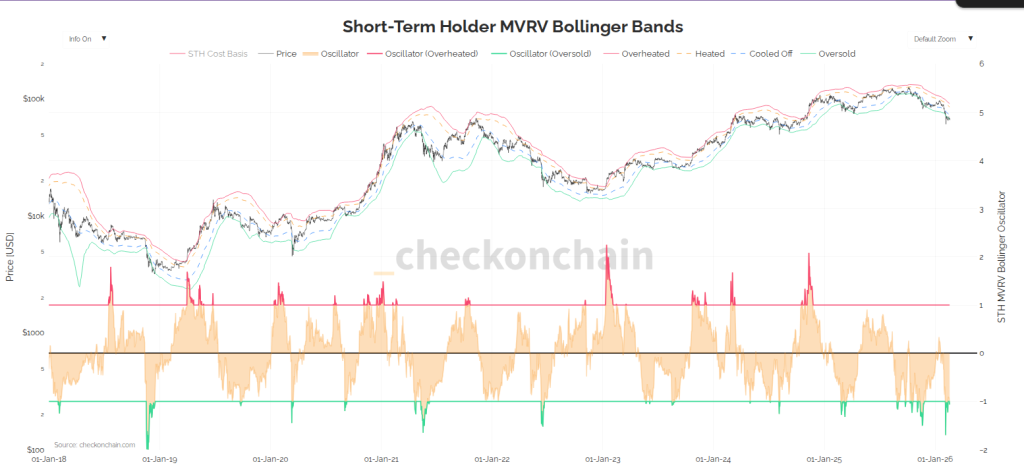

Bitcoin’s Powerful Rally Signal Is Back — Is History About To Repeat?

Markets blinked hard this week. According to Checkonchain, a measure tied to rec...

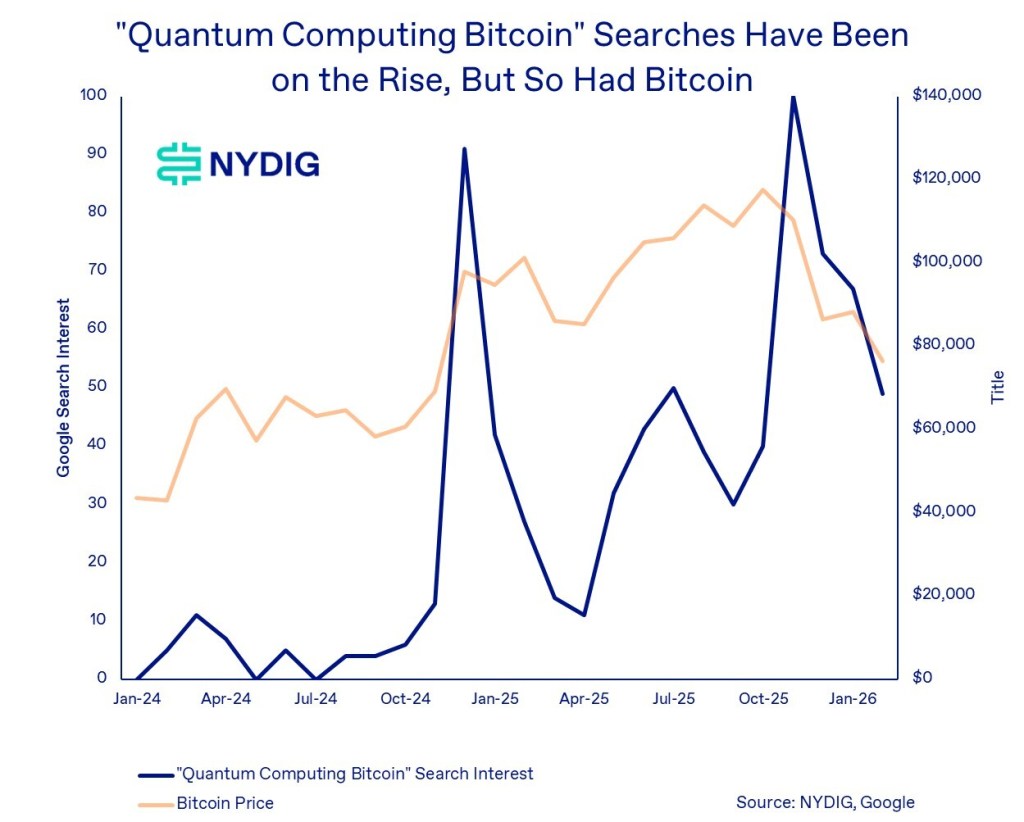

Did Quantum Computing Fears Crash Bitcoin? NYDIG Says No

Quantum computing has become the latest all-purpose explanation for Bitcoin’s re...

Revealed: The Biggest Bitcoin Holders Of 2026, According To Arkham Data

Blockchain analytics platform Arkham has released a new report identifying the l...