Solana Range Compression Is Signaling A Major Move Ahead

Alex Smith

2 hours ago

Solana is tightly compressed inside a defined range after sweeping liquidity on both sides. With volatility fading and pressure building, the current structure suggests a major breakout move could be approaching.

$77–$90 Range Remains Firmly Intact

Solana remains locked inside a well-defined $77–$90 range, with the broader outlook suggesting that any major resolution is more likely to unfold to the downside toward $57. According to Umair Crypto, the price has been consolidating within this band for the past 11 days, with liquidity already swept on both ends. That behavior signals a balanced market environment rather than a trending one.

Currently, Solana is trading below the range’s point of control (POC), which introduces slight short-term bearish pressure. However, from a structural standpoint, the market remains in choppy consolidation.

A short-term move toward $81–$82 remains possible for another rotation higher, and even a marginal push toward $93 could occur if the highs are taken again. Still, unless $90 is decisively reclaimed and flipped into support with strong volume, such moves would likely qualify as deviations rather than sustainable breakouts.

For now, the primary expectation is continued consolidation before a larger expansion phase begins. If the range ultimately resolves to the downside, $57 stands out as the broader target. Until a clear structural shift occurs, this remains a range-trading environment, not trend-trading.

Solana Wyckoff Reaccumulation Unfolding After Brutal Downtrend

Trader Tardigrade recently shared a detailed outlook suggesting that Solana is undergoing a classic Wyckoff Reaccumulation pattern after its prolonged and exhausting grind lower. Following months of distribution-like price action and volatility, the current structure appears to be transitioning into a base-building phase that could eventually support a larger cycle advance if key levels continue to hold.

According to the breakdown, Phase A began with a Selling Climax (SC) near $110 in August 2024, followed by an Automatic Rally (AR) toward approximately $264. Phase B then unfolded through multiple Secondary Tests (STs), alongside a notable Upthrust After (UA) fakeout near $295.

Phase C appears to have completed with a Spring formation around the $68 level in early 2026 — a sharp wick rejection that likely swept liquidity before reversing. The market is now potentially entering Phase D, which would require Solana to firmly hold above $95 for a confirmed Sign of Strength (SOS) rally.

If this structure continues to play out as outlined, projected upside targets include a Last Point of Support (LPS) near $150, a Backup (BU/LPS) zone around $250, and eventually a broader markup phase that could extend toward $350–$500 or higher. However, the bullish thesis remains conditional; SOL must continue to defend the Spring low and demonstrate constructive volume behavior to validate the larger cycle advance.

Related Articles

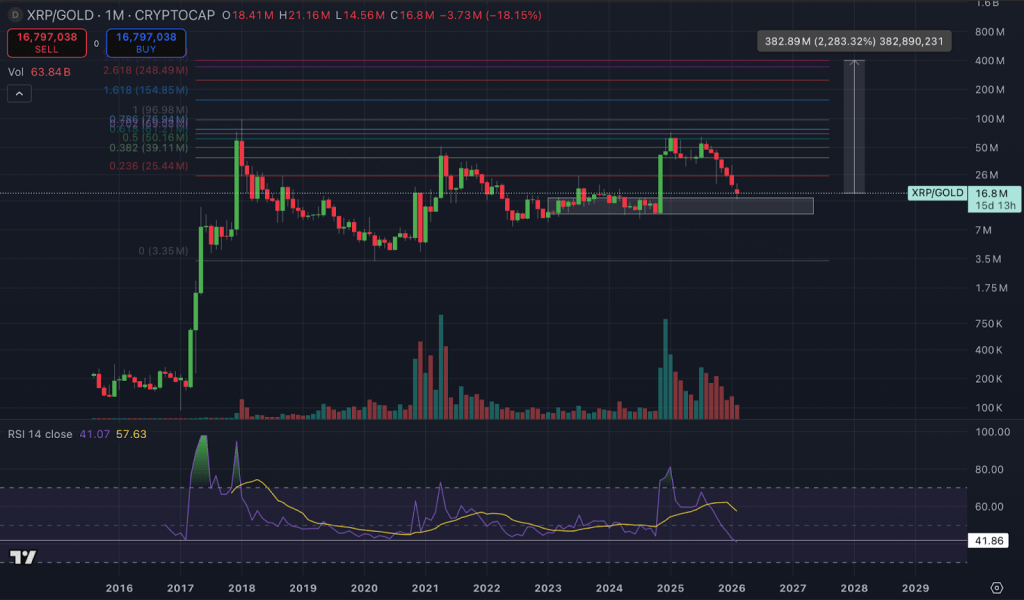

XRP Vs Gold Hits Historic Zone As Sentiment Capitulates: Analyst

Crypto sentiment has slid to what CryptoinsightUk founder Will Taylor describes...

Ethereum Price Near Technical Flashpoint With Big Move Brewing

Ethereum price found support near $1,928 and recovered some losses. ETH is now c...

Bitcoin Price Holds The Line, But Can Bulls Force A Break Higher?

Bitcoin price corrected gains and tested the $67,500 support. BTC is now recover...

Analyst Reveals What XRP Price Will Move Toward In Bid For $4

The XRP price is flashing strong signs of a potential breakout, as one analyst p...