PG Electroplast vs Amber Enterprises: Which EMS stock performed better in Q3?

Alex Smith

11 hours ago

Synopsis: PG Electroplast and Amber Enterprises both had a solid Q3, but they’re heading down totally different paths. PG Electroplast is betting big on white goods outsourcing, while Amber Enterprises is shifting gears toward high-value electronics.

PG Electroplast and Amber Enterprises both recorded strong revenue growth in Q3 FY26, but a closer look reveals their strategies are worlds apart. PG Electroplast is doubling down on room air conditioner outsourcing and scaling up its white goods manufacturing.

Amber Enterprises, by contrast, is pivoting toward higher-value electronics and infrastructure components. So, while both posted impressive December quarter numbers, what’s most striking is how differently these two leaders are planning for the future and where they channel investments, and the strategic paths they’re taking.

India’s contract manufacturing market for consumer durables had a solid performance in the December quarter. Both PG Electroplast and Amber Enterprises, among the sector’s top players, reported robust year-on-year revenue growth in Q3 FY26. At first glance, it appears they’re both benefiting from similar trends, like early channel stocking ahead of the season and a rising trend toward outsourcing.

The December quarter, therefore, was not just about seasonal growth. It was about strategic direction. In this article, we will dive deeper into understanding the driver behind this growth.

PG Electroplast

PG Electroplast reported Rs 1,412 crore in revenue for Q3 FY26, marking a significant increase of 46 percent from Rs 968 crore in the same quarter last year. On a quarter-on-quarter basis, the growth is even more striking, with revenue more than doubling from Rs 655 crore in Q2. This surge is mainly due to a seasonal spike in air conditioner shipments.

Air conditioners are leading this growth. The Room Air Conditioner (RAC) segment rose by over 80 percent year-on-year, contributing about Rs 932.5 crore, or 66 percent of total revenue. Even though the overall industry declined in the first nine months of FY26, PGEL still managed to grow its RAC business by 27 percent over the same nine months. This is largely because brands are increasingly outsourcing, and dealers are stocking up ahead of new energy efficiency regulations.

EBITDA for the quarter stood at Rs 126.1 crore, up 36.5 percent from last year’s Rs 92.5 crore. And as compared to last quarter’s Rs 44.68 crore, it grew by 182 percent. However, margins slipped by about 60 basis points to 8.9 percent, impacted by higher commodity costs and PGEL providing price support to customers during a slow market.

Net profit reached Rs 60.3 crore, a jump of 50 percent from Rs 40.1 crore last year. On a quarter-on-quarter basis, the growth is even sharper, as profits in Q2 were just Rs 2.38 crore, as this quarter faced many challenges, such as prolonged monsoon, weak summer, etc.

The company is not just relying on air conditioners. The washing machine business is also emerging as a strong growth driver, where sales rose over 45 percent year-on-year in Q3 FY26 to Rs 194 crore, and increased 46 percent in the first nine months of the year. PGEL is seeing increased outsourcing in semi-automatic machines and is gradually expanding into the fully automatic segment. Additionally, the television joint venture, Goodworth Electronics, contributed Rs 670 crore over nine months, further diversifying PGEL’s revenue streams.

Looking ahead, PG Electroplast is maintaining its full-year (FY26) revenue target of Rs 5,700–5,800 crore, aiming for 17–19 percent growth over last year, and the total group (including Goodworth Electronics) is aiming for a revenue of Rs 6,550-6,650 crore, which is a growth of 21-23 percent.

Along the segments, the company is aiming to grow its products segment revenue by 17-21 percent, followed by electronics by 29 percent, Goodworth Electronics by 57 percent. While its Net profit is expected to be between Rs 300 and 310 crore, which is a growth of 3-7 percent from the previous year.

To support this growth, PGEL plans to invest Rs 700–750 crore in FY26. The company is building a new refrigerator plant in South India with a capacity of 1.2 million units, expanding washing machine capacity in Greater Noida, increasing AC output in Supa, and setting up a plastics and cooler facility in Rajasthan.

The strategy remains consistent: scale up manufacturing across all major white goods categories and reinforce PGEL’s position as the preferred outsourcing partner for India’s leading consumer durable brands.

Amber Enterprises India

Amber Enterprises posted Rs 2,943 crore in revenue for Q3 FY26, which is a solid 38 percent jump from last year’s revenue of Rs 2,133 crore. Additionally, on a QoQ basis, revenue grew by 79 percent from Rs 1,647 crore.

EBITDA for the quarter stood at Rs 237.47 crore, up 59 percent from last year’s Rs 149.73 crore. And as compared to last quarter’s Rs 83.77 crore, it grew by 183 percent. Additionally, margins grew by about 105 basis points to 8.07 percent,

Despite strong EBITDA growth in Q3 FY26, Amber slipped into a net loss of Rs 9.34 crore mainly due to pressures below the operating level. Higher depreciation and finance costs from ongoing capacity expansion reduced profits, while a one-time Labour Code impact added an exceptional charge of Rs 9.33 crore at the consolidated level (Rs 5.66 crore standalone).

In addition, the company recognised an impairment related to its Rs 93.76 crore total exposure (Rs 64.02 crore equity + Rs 29.74 crore loan) in Shivaliks Mercantile, which has financial stress at its Italian associate Firema. These non-operating and exceptional items outweighed the strong operating performance, resulting in the reported loss. However, unlike PGEL, Amber didn’t depend on just one business line. Growth came from every segment.

The Consumer Durable division, which handles RAC manufacturing, delivered Rs 1,971 crore this quarter, up 27 percent from last year. This was largely driven by dealers stocking up ahead of energy rating changes, along with consistent demand from their core customers.

But the Electronics division really stood out. Revenue there surged nearly 79 percent to Rs 845 crore. The main factors were strong demand for printed circuit board assemblies, bare PCBs, and Amber’s expansion into power electronics and automation.

This isn’t just about the numbers; it shows Amber is shifting beyond just making air conditioners. They’re moving into higher-value electronics manufacturing services. Management says they’re targeting double-digit EBITDA margins in electronics by FY27.

Railways and Defence also performed well, with revenue hitting Rs 127 crore, which is a 20 percent increase over last year. The order book here is healthy too, over Rs 2,600 crore, and the management expects this segment’s revenue to double over the next two financial years.

Looking forward, Amber isn’t making big headline forecasts. For Consumer Durables, they’re targeting 13–15 percent growth, even as the industry slows. In its Electronics division, the company expects its EBITDA margins to achieve double digit driven by growth momentum and strategic actions.

Additionally, the company is investing in new PCB facilities, expanding electronics in Tamil Nadu, and building railway subsystem plants. The big picture: create a diversified manufacturing platform that isn’t just tied to the fortunes of the RAC business.

Strategic Divergence

PG Electroplast and Amber Enterprises are taking different paths, even though they operate in the same sector. PGEL is focusing on ramping up its outsourcing for RACs and other white goods. Its profitability hinges on pushing higher volumes, and it’s closely linked to the seasonality of demand. At present, the company is expanding its capacity in refrigerators and washing machines, aiming to diversify its consumer durables portfolio.

Amber is moving in another direction. The company is pivoting towards electronics and infrastructure manufacturing. This transition is driving revenue growth, but it’s also squeezing profits for now, mainly due to increased investments and expansion costs.

Looking ahead, PGEL appears to have more stable earnings as its revenue and profit targets are well-defined. Amber, in contrast, is playing for the long term. It’s building a broader electronics ecosystem, prioritising future growth over immediate gains.

Both companies reported strong revenue growth for Q3 FY26, but they’re clearly not following the same strategy. PG Electroplast is committed to a scale-driven model, doubling down on RAC outsourcing and white goods. Its approach is straightforward: reliable seasonal performance, clear outlook, and steady near-term profits.

Amber Enterprises is transforming itself, becoming a more diversified electronics manufacturing services provider. It’s less reliant on the air conditioner segment and its seasonal cycles, but this shift is putting temporary pressure on profits.

For investors, it comes down to priorities. PGEL offers near-term growth by scaling up volumes and broadening its white goods business. Amber is promising a deeper transformation, a move into higher-value electronics manufacturing, even if that means waiting longer for substantial profits.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post PG Electroplast vs Amber Enterprises: Which EMS stock performed better in Q3? appeared first on Trade Brains.

Related Articles

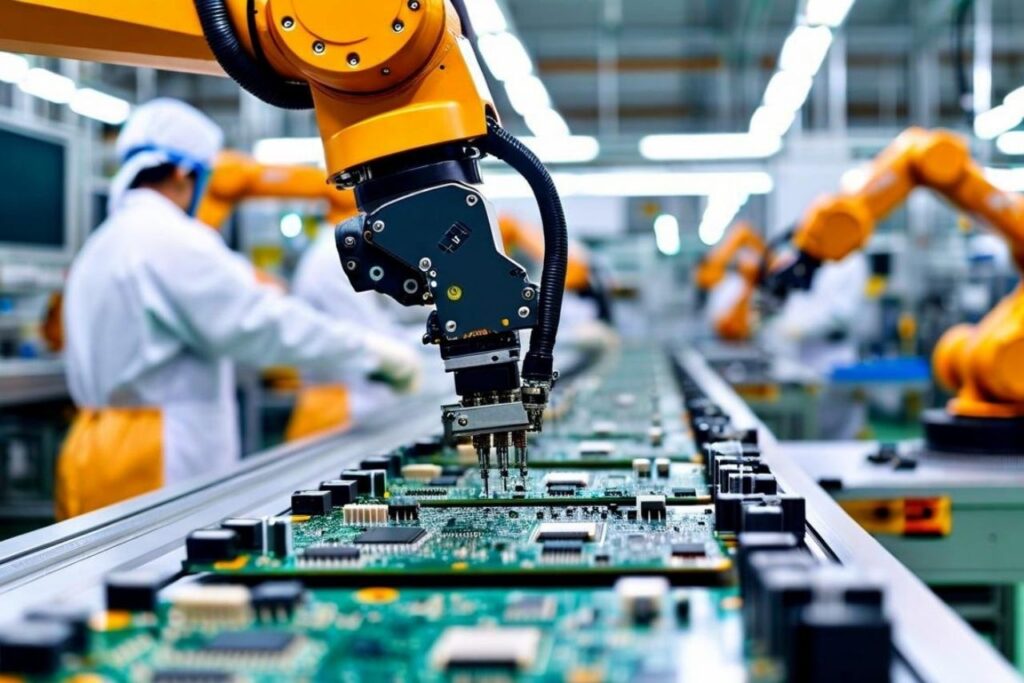

How India Became Apple’s iPhone Manufacturing Hub and How You Could Benefit

Synopsis: Apple is now producing more iPhones in India, and this brings billions...

Top 5 Power Stocks and Their Operational Capacity as of Q3 FY26 to Keep an Eye On

Synopsis: India’s growing power sector underscores the importance of operational...

Ambuja vs Ultratech: What Are the Brokerages Telling About the Cement Stocks Post Q3 Results?

Synopsis: Ambuja and UltraTech announced Q3FY26 results, where one saw 27 percen...

Siemens Energy: Should you buy or sell this power stock after Q3 results?

Synopsis: Siemens Energy India shares in focus after Jefferies initiated a ‘Buy’...