Not Just Crypto: Research Says XRP Is Moving Into Bank-Grade Payment Infrastructure

Alex Smith

2 months ago

XRP is being positioned as something more than a trading asset as analysts point to signs suggesting it may be shaped for financial infrastructure over time.

A report from Digital Asset Solutions (DAS) highlights three main points behind this shift, tying the altcoin’s technical setup to Ripple’s work on stablecoins and regulated payment rails.

Structural Edge For XRP

Reports have disclosed that XRP offers several qualities that matter to companies moving money across borders. It settles fast, costs little to send, and works as a neutral bridge asset between different currencies.

Ripple’s ledger is described as reliable and globally distributed, which is why some enterprises are testing it for predictable transfers. However, many firms still use RippleNet without using the crypto directly, so broad bank-level usage has not taken hold.

DAS Research just laid out the clearest confirmation yet of where XRP is heading

Their analysis shows XRP and Ripple are no longer competing in crypto. They are evolving into global payment infrastructure, the kind used by banks, fintechs, and cross border networks that… pic.twitter.com/ZwqUD68Qur

— Stern Drew (@SternDrewCrypto) December 9, 2025

The research frames these features as the first major factor behind the digital asset’s potential role in global payment flows. The traits are real, but adoption varies and has not yet reached large commercial scale.

Stablecoins And XRP Working Together

Ripple plans to use RLUSD as a fiat-backed anchor while relying on the crypto to provide liquidity between different corridors.

The concept is simple: Stablecoins maintain price stability tied to fiat, while XRP acts as the connector for moving value across currencies. This pairing is presented as the second major point in DAS Research’s findings.

Ripple Prime, ZK-enabled identity tools, and licensing efforts are being built to meet compliance requirements from regulated institutions.

Early RLUSD corridors have started to appear, but the level of real-world transaction volume remains small compared to the broader payments industry.

Catalysts Forming In The BackgroundThe final point focuses on developments that analysts believe could help XRP move closer to regulated financial rails.

RippleNet partnerships are growing, institutional custody services are improving, RLUSD integrations are underway, and conversations around possible ETF structures have emerged.

Each of these adds some weight to the idea that XRP may gain a deeper role in payment systems in the future. Some of these steps are active today, while others remain early discussions. Custody upgrades, for example, are happening across the crypto sector, not only for the altcoin.

While procedural steps like exchange listings and filings have progressed for multiple XRP ETF proposals, the US Securities and Exchange Commission has not yet given formal approval to a spot XRP ETF. Even so, these developments show how Ripple is preparing for broader institutional use.

Featured image from Unsplash, chart from TradingView

Related Articles

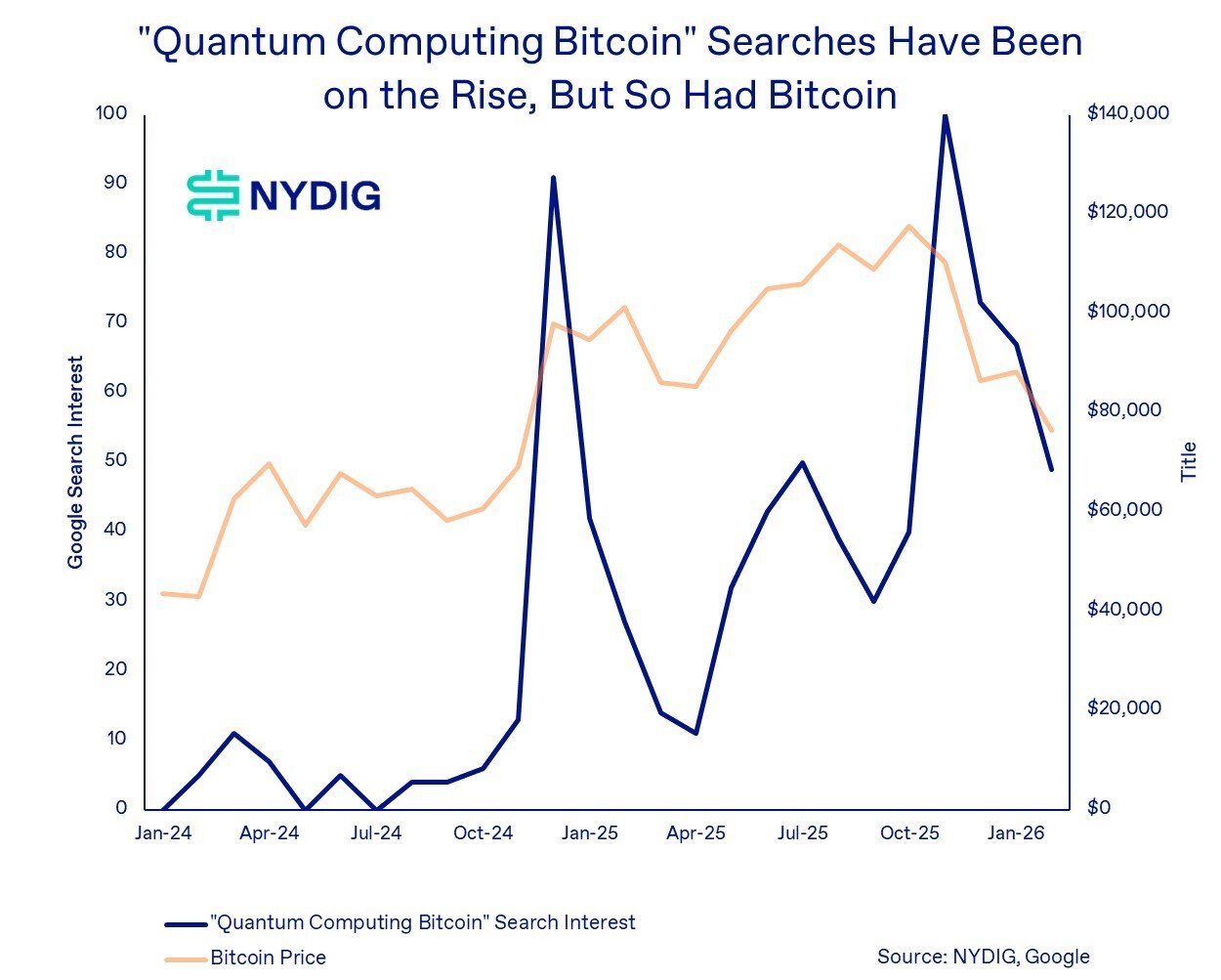

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...

Crypto Watchlist: The Key Catalysts To Track This Week

Crypto’s week is stacked: ETHDenver pulls builders into Denver, a major DAO vote...

Brian Armstrong Praises ‘Diamond Hands’ as Coinbase Reports Strong Retail Activity

Retail investors appear to be holding their ground through the latest wave of cr...