Is Tether Abandoning Bitcoin For Gold? $1 Billion Monthly Buys Boost Reserves

Alex Smith

2 weeks ago

Tether CEO Paolo Ardoino has revealed that the USDT issuer has increased its gold purchases and plans to continue doing so over the next few months. This has prompted speculation that the stablecoin issuer is abandoning Bitcoin for the precious metal, though that is not the case.

Tether To Keep Investing In Both Bitcoin and Gold

According to a Reuters report, the Tether CEO said his company plans to continue investing in Bitcoin and gold as its reserve assets. He stated that it was reasonable to allocate approximately 10% of their portfolio to BTC and 10%-15% to gold. The stablecoin issuer notably uses gold as part of the reserves for the USDT stablecoin and also to back its XAUT gold token, which has a market cap of $2.6 billion.

Bloomberg reported that the USDT issuer holds approximately 140 tons of gold, according to Ardoino. The stablecoin issuer’s holdings are valued at around $24 billion, representing the largest known hoard outside central banks, ETFs, and commercial banks. In a recent release, Tether announced that it now ranks among the top 30 global gold holders, surpassing countries such as Greece, Qatar, and Australia.

The Tether CEO revealed that they have been buying at a rate of about one to two tons a week and plan to keep doing so for at least the next few months. At current prices, that equates to about $1 billion in monthly purchases. Despite the significant interest in gold, the USDT issuer has not abandoned its Bitcoin strategy.

Tether purchased 8,888 Bitcoin, valued at approximately $779 million, in the fourth quarter of last year. The stablecoin issuer currently holds 96,370 $BTC($8.46 billion) in total. Based on these holdings, it ranks as the second-largest corporate Bitcoin holder, only behind Michael Saylor’s Strategy, which holds 712,647 BTC.

The Long-Term Goal For Tether

During his interview with Bloomberg, Ardoino described Tether’s role in the gold market as similar to a central bank. This came as he said the stablecoin issuer is effectively becoming one of the world’s largest gold central banks. Their bullish outlook for gold appears to partly stem from the belief that America’s geopolitical rivals will launch a gold-backed alternative to challenge the dollar’s status as the reserve currency.

Meanwhile, the Tether CEO revealed that they aren’t looking to only hold gold but also trade it, competing with banks in trading the precious metal. Ardoino stated that they need to be the best gold trading floor in the world to continue accumulating it over the long term. His comments come at a time when gold is reaching new all-time highs (ATHs) above $5,300. Meanwhile, Bitcoin continues to lag, trading below $90,000.

Related Articles

Former White House Crypto Adviser Confident CLARITY Act Will Pass As Deadline Nears

A former White House crypto adviser has shared his thoughts on the delay of the...

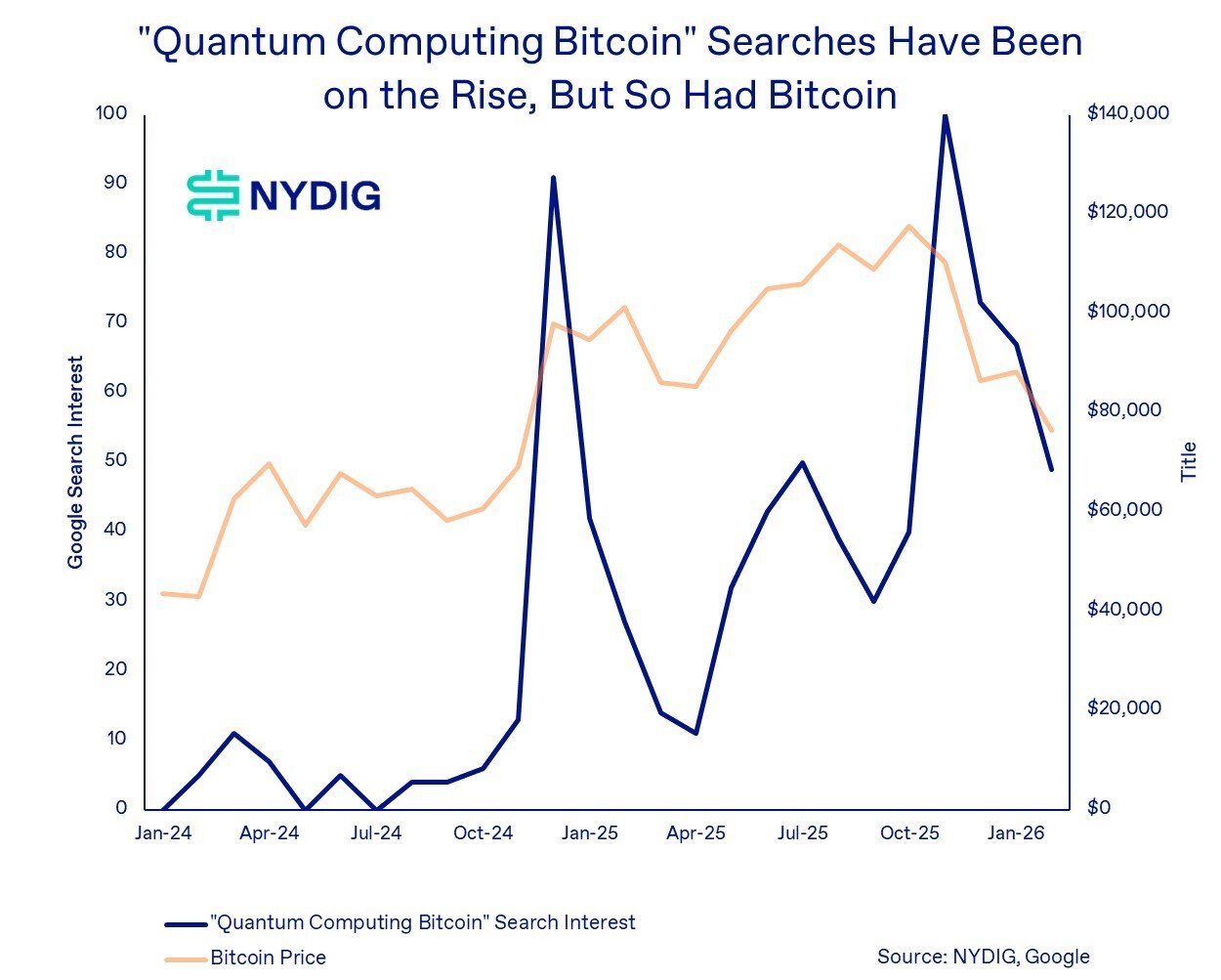

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...

Crypto Watchlist: The Key Catalysts To Track This Week

Crypto’s week is stacked: ETHDenver pulls builders into Denver, a major DAO vote...