Glassnode: XRP Is Back In Its 2021-2022 Playbook As SOPR Drops Sub 1

Alex Smith

6 days ago

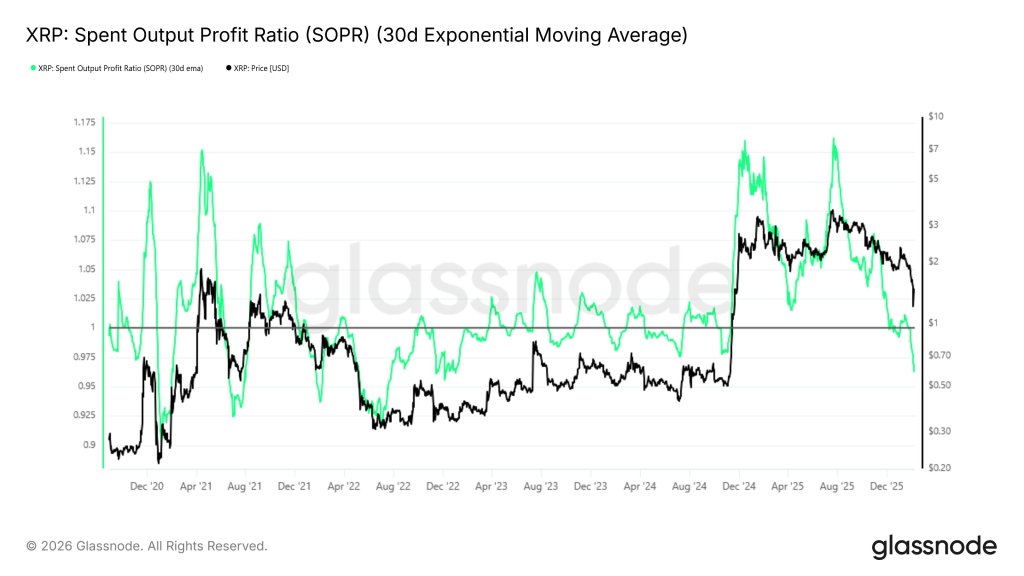

XRP is flashing a familiar on-chain stress pattern after slipping below its aggregate holder cost basis, a move Glassnode says has historically coincided with capitulation, loss realization, and a slow grind toward stabilization rather than an immediate rebound.

In a Feb. 9 post on X, the on-chain analytics firm said XRP “lost its aggregate holder cost basis, triggering panic selling,” pointing to a sharp deterioration in spent output profitability. Glassnode flagged its Spent Output Profit Ratio (SOPR) on a 7-day EMA basis falling from 1.16 in July 2025 to 0.96 “now,” adding that “holders are realizing significant losses” and that “on-chain profitability flipped negative.”

SOPR prints below 1 are typically read as the market spending coins at a loss on aggregate, a regime that can persist when sellers are forced to exit and bids are primarily coming from buyers with longer horizons. In Glassnode’s framing, that’s what makes the current setup rhyme with a prior XRP cycle: “This setup closely resembles the Sep 2021–May 2022 phase, where SOPR plunged to a

Related Articles

XRP Outlook Slashed: Standard Chartered Lowers Forecast From $8 To $2

The British financial giant Standard Chartered sharply reduced its price outlook...

Ethereum Whale Losses Mirror Past Bottoms: Accumulation Continues Despite Pressure

Ethereum continues to struggle under persistent selling pressure, with price act...

Historic Trend That Led XRP To A Sharp 40% Trend Has Just Reappeared

XRP may be approaching a significant technical moment after returning to an impo...

Can XRP Hold Above $1? Token Tumbles 11% as Breakdown Fuels Crash Concerns

XRP is once again under pressure as renewed selling activity and weakening marke...