Expert Alleges Bitcoin Under Siege Again, ETFs And BlackRock Suspected

Alex Smith

1 month ago

The recent surge in Bitcoin (BTC) volatility has led to significant liquidations, prompting renewed suspicions of market manipulation among experts.

Institutional Sell-Off?

A detailed analysis by market expert NoLimit on the social media platform X (formerly Twitter) reveals that, at the time of the stock market opening, BlackRock’s Bitcoin exchange-traded fund (ETF) IBIT transferred hundreds of millions of dollars’ worth of Bitcoin into Coinbase Prime wallets.

This timing and location indicate a pattern that institutions often follow when selling their assets. As explained, these coins are not sent to Coinbase Prime merely to remain inactive; they are typically directed there for sale or liquidity management purposes.

NoLimit asserts that when a major player like BlackRock needs to liquidate assets or meet redemption demands, the price of Bitcoin reacts rapidly.

He suggests that this situation reflects a combination of factors: selling related to ETFs taking place during low liquidity, inventory management in anticipation of upcoming volatility, and risk reduction in light of a significant derivatives event.

Bitcoin Faces Sharp Decline

Compounding these concerns, technical analyst OxNobler highlighted further developments that contributed to the recent downturn, detailing significant sell-offs by various trading platforms.

In a rapid succession of transactions, Binance reportedly sold 10,155 BTC, Wintermute let go of 5,354 BTC, Coinbase disposed of 10,113 BTC, BlackRock sold 4,945 BTC, and Kraken moved 4,630 BTC.

Collectively, these actions amounted to over $2.5 billion worth of Bitcoin sold within a mere 30 minutes, raising suspicions of coordinated market manipulation.

According to analysts from Bull Theory, the situation has taken a dire turn, with Bitcoin plummeting by $2,300 and liquidating $66 million in long positions in just 45 minutes.

Against this backdrop, $60 billion has been wiped from the crypto market without any negative news triggering such a drastic shift. This scenario has led them to assert that manipulation continues to be a significant concern within the broader crypto market.

At the time of writing, BTC was trading at $87,340, down slightly more than 30% from its all-time highs set earlier in October.

Featured image from DALL-E, chart from TradingView.com

Related Articles

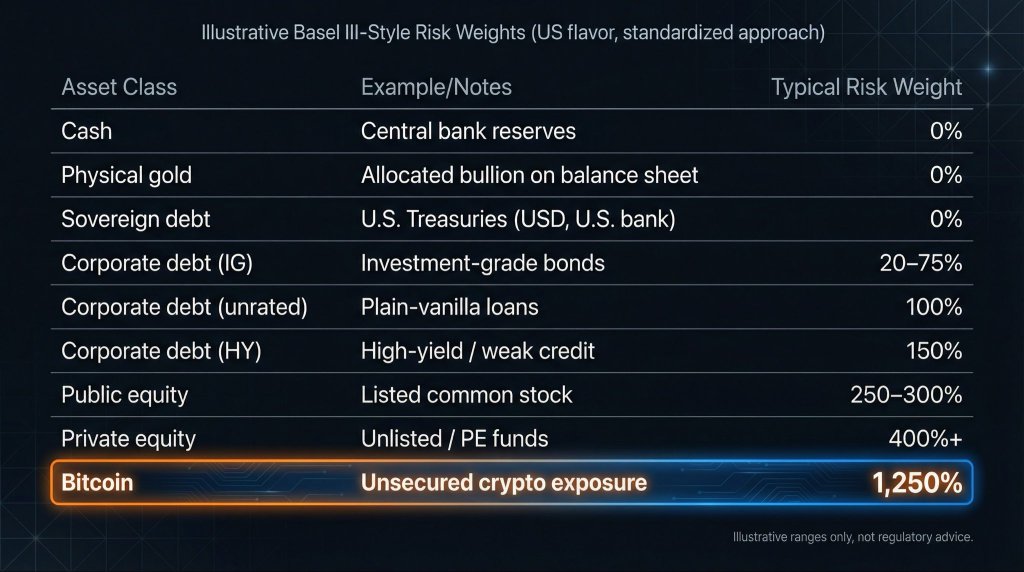

Basel Banking Standards Vs Bitcoin: Strategy CEO Blasts 1,250% Risk Weight

Strategy CEO Phong Le is calling for a rethink of how banks are required to capi...

Bitcoin Losses Now Equal 19% Of Market Cap, Echoing May 2022

Analytics firm Glassnode has highlighted how the current Bitcoin market pain ech...

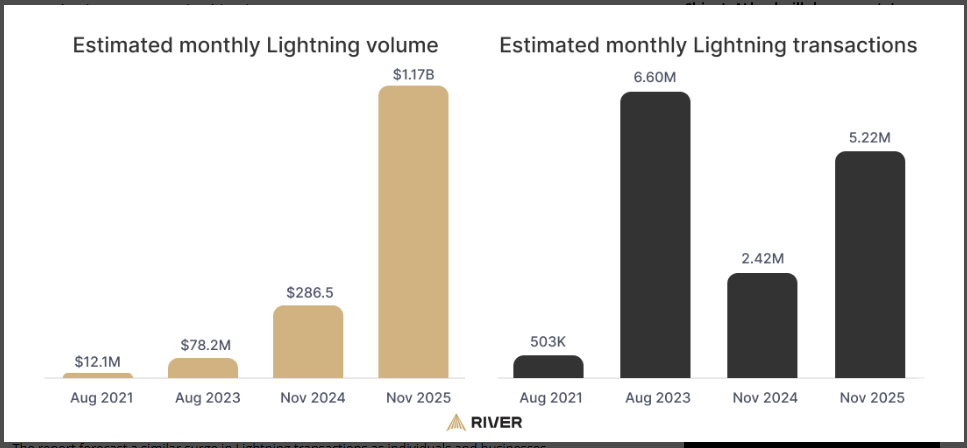

Lightning Strikes Big: Bitcoin Layer-2 Surpasses $1 Billion In Monthly Activity

A clear sign of more than hobbyist use: monthly Lightning activity climbed past...

Every Ethereum Whale Cohort Now Underwater: ETH Capitulation Marking The Final Bottom?

Ethereum continues to struggle below the $2,000 level as persistent selling pres...