Ethereum Emerges As Likely Candidate In BlackRock Tokenization Vision – Here’s Why

Alex Smith

3 weeks ago

Recent remarks from BlackRock CEO Larry Fink have pointed toward the need for a single, unified blockchain for tokenized markets, and have intensified the focus on platforms capable of handling institutional-scale liquidity, compliance, and settlement. With its long track record in smart contracts, extensive developer ecosystem, and growing role in regulated financial products, Ethereum is now emerging as the most likely candidate to serve as the settlement layer for tokenized capital markets.

Why Asset Managers Prefer Familiar Infrastructure

In an X post, the Ethereum Daily shared a video in which BlackRock CEO Larry Fink made it clear that tokenization is necessary. Speaking at the World Economic Forum, Fink said the financial system must move rapidly toward digitization, adding that a single, common blockchain could reduce corruption and improve transparency across the global markets.

While Fink did not name a specific network, the most plausible candidate could be ETH, based on BlackRock’s own initiatives and public statements that emphasized the role of ETH in asset tokenization. The firm has consistently highlighted ETH as a core platform for its on-chain strategy. Meanwhile, BlackRock launched its BUIDL tokenized money market fund directly on ETH, a product that has already grown to over $2 billion in total value locked. “There’s no second best,” Ethereum Daily noted.

In the staking space, Bitmine has turned Ethereum staking into a multi-billion-dollar business. An analyst known as Milk Road has revealed that the company now has 1.83 million ETH staked, worth roughly $6 million at current prices, and plans to scale that figure toward 4.2 million ETH over time. Over the past months, Bitmine Immersion Technologies Inc. (BMNR) has accounted for nearly 50% of all new ETH entering the staking queue.

Staking at this scale is important because it removes ETH from the liquid supply and locks it into long-term infrastructure rather than keeping it for short-term trading. When one player is willing to commit billions of dollars worth of ETH to staking, it reflects confidence in ETH’s future economic prospects. A lower liquid supply, combined with sustained network demand, will create structural pressure over time.

How Support Built Through Multiple Market Cycles

Analyst Milk Road has also highlighted that Ethereum is holding near a critical support zone around $3,000, hovering just above the lower boundary of its long-term rising structure, an area that has acted as a stress test for ETH throughout the cycle. Historically, when ETH drifts into this area, the market will need to decide whether the weakness is temporary or structural.

The $2,750 level remains the key line because it has repeatedly stopped downside pressure after macro-driven or narrative-driven pullbacks, making it a reliable floor for the broader trend. As long as ETH holds above that level, the broader multi-year uptrend will remain intact.

Related Articles

DOGE Price Slips 3% Daily, Break Below $0.098 Could Trigger Further Dogecoin Downside

Dogecoin (DOGE) is currently testing investor confidence as the memecoin hovers...

Dogecoin Has Now Broken Out Of A Descending Triangle, Here’s The Next Stop

Dogecoin might be trading at $0.1, but is already flashing signs of a structural...

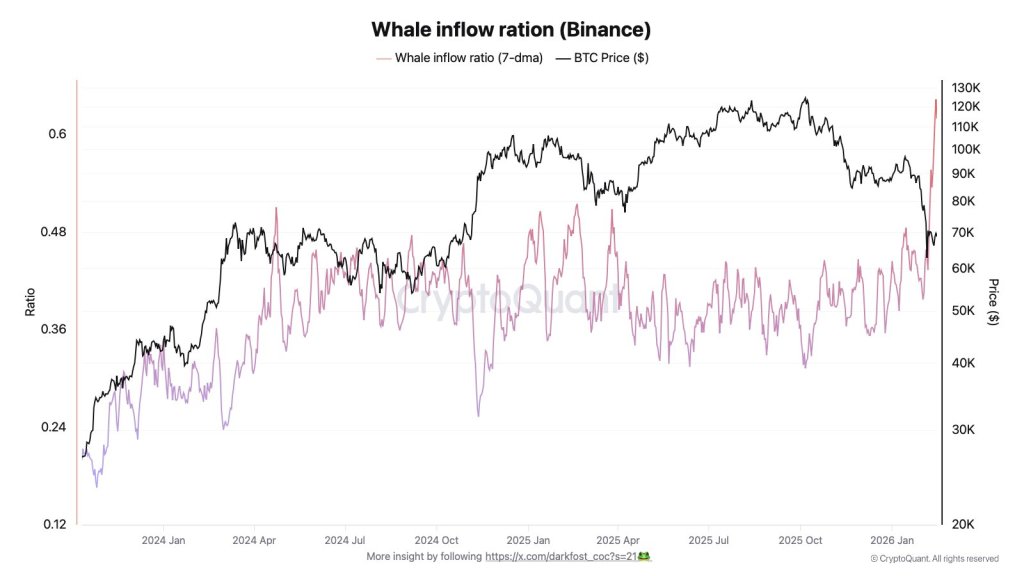

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...