Economist Blasts Strategy’s Bitcoin Bet, Despite $8 Billion Profits, Here’s Why

Alex Smith

1 month ago

On Monday, December 29, 2025, Michael Saylor’s Strategy (formerly MicroStrategy) announced its latest Bitcoin purchase. The company had acquired over $100 million worth of the digital asset again, keeping in line with its consistent buying over the years. While Strategy’s large Bitcoin buys have often been a cause for celebration in the crypto community, not everyone believes that this is a good strategy. Mainly, world-renowned economist Peter Schiff has blasted the move, highlighting its profits so far as subpar.

Strategy’s Bitcoin Move Would Have Been Better With Any Other Asset

Schiff’s comments come hot on the heels of the Strategy announcement, showing a total of 1,229 BTC was bought at approximately $109 million. The average purchase price for the coins came out to around $88,568 once the purchase was done, adding to the already considerable Bitcoin holdings of the publicly-held company.

Less than 30 minutes after Strategy’s announcement, Peter Schiff took to the X (formerly Twitter) platform to share his thoughts on the move. Mainly, the economist is not impressed with how the company’s Bitcoin bet has played out so far, despite sinking over $50 billion into the digital asset.

Schiff points out that despite aggressively buying BTC over the last five years, Strategy’s profits sit at only 16%. Breaking this down over the number of years that the company has been buying Bitcoin, it averages out to around a 3% annual profit on the investment.

Given this, the economist believes that the company would’ve been better off if it had accumulated any other asset besides Bitcoin. Interestingly, the prices of other assets such as gold and silver have hit new all-time highs this year, while BTC has continued to struggle.

Breaking Down Strategy’s BTC Holdings

Presently, Strategy retains its title as the publicly-traded company with the highest amount of Bitcoin holdings. According to data from the data aggregation website, CoinGecko, Strategy currently holds 672,497 BTC, which accounts for 3.202% of the total Bitcoin supply.

The entire stack has cost the company a whopping $50.44 billion to accumulate, with an average price of $74,997 at the time of the last purchase. At a 16% profit margin so far, Strategy is currently sitting on over $8 billion in unrealized profits, down from its all-time high of $22 billion in profits when the Bitcoin price crossed $126,000 back in October.

Related Articles

If You’re Wondering When The Next Bitcoin Bull Run Will Begin, You Should See This Chart

Market participants continue to search for reliable signals that can define the...

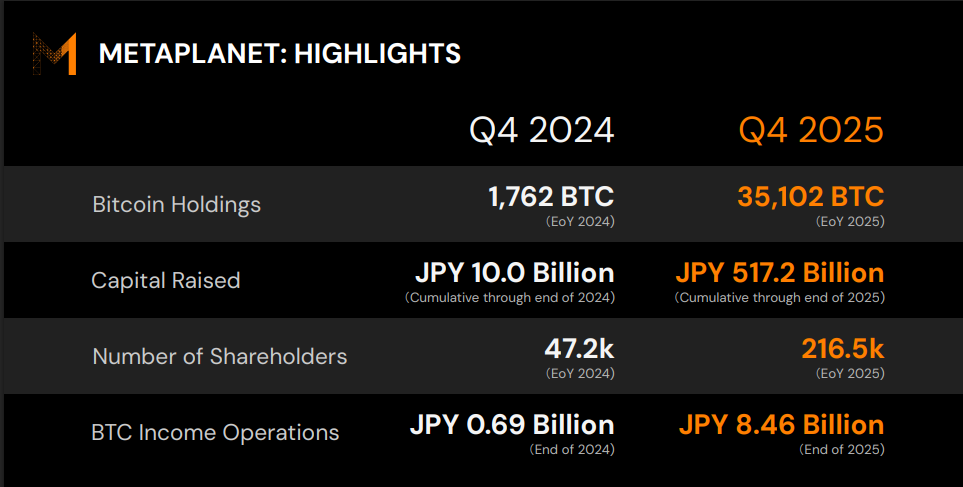

Bitcoin Boost: 95% Of Metaplanet’s Revenue Comes From Crypto

Metaplanet posted a dramatic swing in its latest results after shifting much of...

XRP Dev Predicts Market Cap To Hit $300 Billion Soon, What Would The Price Be?

A new technical projection is circulating in the crypto market after pseudonymou...

Years After NFT Clash, Logan Paul Sells Pokémon Card For Guinness Record $16.5M

YouTube star Logan Paul has turned a pop culture prop into a record. Based on re...