California Wealth Tax Odds Signal Uncertainty as Billionaires Leave the State

Alex Smith

1 month ago

Prediction markets are currently pricing the odds of the California billionaire tax passing as roughly a coin flip, but it’s a gamble that several ultra-wealthy residents aren’t willing to take.

Even though the proposed one-time 5% wealth assessment is not guaranteed to make it onto November’s ballot, the mere threat of the tax is already reshaping behavior. Billionaires are reportedly cutting ties with California and racing against the clock ahead of a key residency date. If approved by voters, the “California Billionaire Tax Act” would apply retroactively to anyone considered a California resident as of Jan. 1, 2026 whose net worth exceeds $1 billion.

Prediction markets suggest passage remains far from certain. But real-world actions, from residency changes to business relocations, indicate that at least some of the wealthiest individuals in the state are treating the risk as credible.

Several high-profile billionaires have reportedly taken steps to exit or restructure their California ties, including Google co-founders Larry Page and Sergey Brin and PayPal co-founder Peter Thiel. Some tech founders and wealth managers warn the tax could dampen innovation, investment, and long-term revenue if enough capital permanently relocates.

While the true fiscal and cultural impact is difficult to quantify, prediction markets offer an early, data-driven signal of how seriously traders and insiders are taking the proposal.

California wealth tax threat spurs California billionaire flight

California determines residency based on the strength of a person’s ties to the state, not just formal address changes. Factors include time spent in California and the maintenance of significant business operations. Under the current proposal, if approved in November, the tax would apply retroactively to anyone deemed a California resident as of Jan. 1, 2026, even if they relocate later.

That retroactivity has injected urgency into decision-making among the ultra-wealthy.

As written, the wealth tax would apply to roughly 200 California residents and is expected to generate revenue in the tens of billions of dollars. Supporters argue the funds could help address budget shortfalls in health care, education, and social services, with 90% earmarked for public health care services.

Reports suggest the list of wealthy individuals restructuring or leaving California continues to grow. Advisers to high-net-worth clients have warned that more exits could follow, with the New York Post reporting that as many as 20 additional billionaires are exploring relocation.

Among the most prominent reported moves:

- Larry Page: The Google co-founder has reportedly relocated residency and restructured multiple business entities across Delaware, Nevada, Florida, and Texas, according to Business Insider.

- Peter Thiel: The PayPal co-founder announced plans on New Year’s Eve to open a Miami office for Thiel Capital as he shifts residency to Florida.

- David Sacks: The venture capitalist and White House AI czar announced a new office location in Austin, Texas, also on New Year’s Eve.

Relocation of business entities is a key component of these shifts. In addition to lost state and local tax contributions, California risks losing pieces of its innovation economy as companies and capital move elsewhere.

In Page’s case, he moved not just his personal residence but also several established and startup business ventures. Business Insider reports that several entities tied to his business and philanthropic activities, including his family office, aviation ventures, AI startups, and conservation initiatives, have been re-incorporated or relocated outside California.

Not everyone is leaving

Not every billionaire is fleeing California. Nvidia CEO Jensen Huang has publicly said he is “perfectly fine” with the proposed tax, despite the fact that it would translate into a one-time assessment of roughly $7 billion on his estimated $155.8 billion fortune.

Huang has said he plans to keep Nvidia headquartered in Silicon Valley, citing the region’s talent pool and ecosystem.

“We chose to live in Silicon Valley, and whatever taxes I guess they would like to apply, so be it.”

For prediction markets, Huang’s stance serves as a counter-signal. It highlights a divergence in how ultra-wealthy individuals assess the risk, and may in part help explain why market odds have hovered near 50% rather than moving decisively in one direction.

Potential real estate ripple effects

David Sacks added fuel to the debate on New Year’s Day when he suggested on X that Miami could replace New York as the country’s financial center, and Austin could replace San Francisco as the new hub for tech innovation.

As a response to socialism, Miami will replace NYC as the finance capital and Austin will replace SF as the tech capital.

— David Sacks (@DavidSacks) January 1, 2026

Sacks’ prediction sparked mixed reactions. While rhetoric alone doesn’t move markets, prediction platforms offer a way for participants to put capital behind such views.

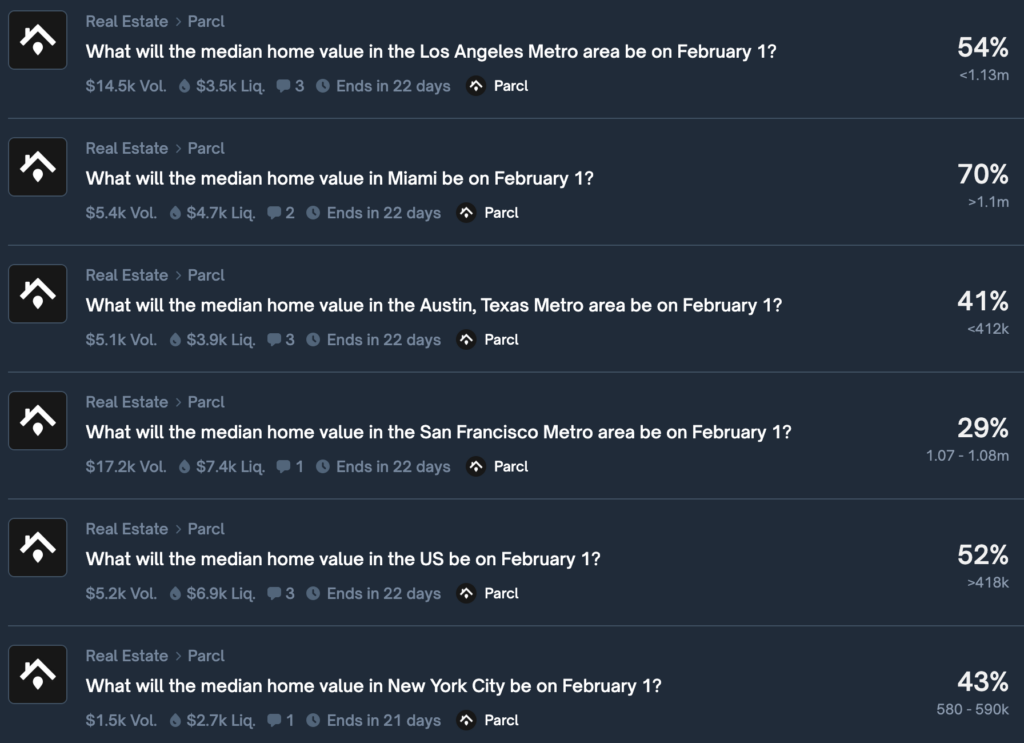

Earlier this week, Polymarket announced a partnership with Parcl, a DeFi protocol focused on real-time real estate price exposure. The integration allows traders on Polymarket’s global platform to take positions on median home price movements in major U.S. cities, including San Francisco, Los Angeles, New York, Miami, and Austin. Note: These real estate markets are not yet available on Polymarket U.S.

While liquidity remains relatively low, the markets offer a real-time barometer of sentiment around housing trends, which is particularly relevant if capital flight from California accelerates. Though they don’t establish causality, these markets may help cut through conflicting narratives by aggregating forward-looking expectations.

Political implications

The wealth tax proposal has also exposed growing rifts within the Democratic Party.

Supporters, including the Service Employees International Union–United Healthcare Workers West, frame the measure as a solution to health care funding gaps exacerbated by recent Medicaid cuts. Progressive figures such as Bernie Sanders have backed the proposal, while other prominent Democrats, including California Governor Gavin Newsom, have publicly opposed it.

The issue has already triggered political backlash. Hedge fund billionaire Bill Ackman recently criticized Rep. Ro Khanna after Khanna voiced support for the tax, accusing him of reversing earlier positions on wealth taxation.

As the proposal advances, the debate is increasingly testing ideological fault lines within the party, dynamics that could eventually show up in prediction markets tied to both policy outcomes and political influence.

Khanna is currently favored to run for the Democratic presidential nomination with odds around 81% at Kalshi. Newsom is also likely to run (88%) and is the current favorite at 35% in Democratic nominee odds.

California wealth tax odds and price analysis

Volume and liquidity in prediction markets tracking whether the California wealth tax will pass remain thin. Low liquidity reflects both caution and uncertainty rather than a clear directional view.

Traders should be careful not to over-interpret headline momentum. Structural and legal hurdles remain significant, beginning with the requirement that organizers gather nearly 875,000 valid signatures by June 24 to qualify for the November ballot, a threshold that appears achievable.

Beyond that, multiple legal challenges loom. Several counter-initiatives have already been filed with the goal of undermining the wealth tax or making it difficult to enact, even if voters approve it.

Low volume may itself be a telling signal here: markets appear to be pricing genuine uncertainty rather than a mispriced outcome.

The signal in the noise

There’s little question that at least some capital has already moved in response to the threat of California’s billionaire wealth tax. Whether the measure ultimately passes, or simply continues to loom, it may influence where future founders choose to build companies and where investors deploy capital.

For observers and traders alike, prediction markets offer a useful complement to traditional political coverage. They won’t eliminate uncertainty, but they can help cut through narrative noise by aggregating how participants are weighing legal risk, political momentum, and real-world behavior.

As the proposal advances, those signals may become increasingly valuable not just for assessing whether the tax will pass, but for understanding its broader economic and political ripple effects.

The post California Wealth Tax Odds Signal Uncertainty as Billionaires Leave the State appeared first on DeFi Rate.

Related Articles

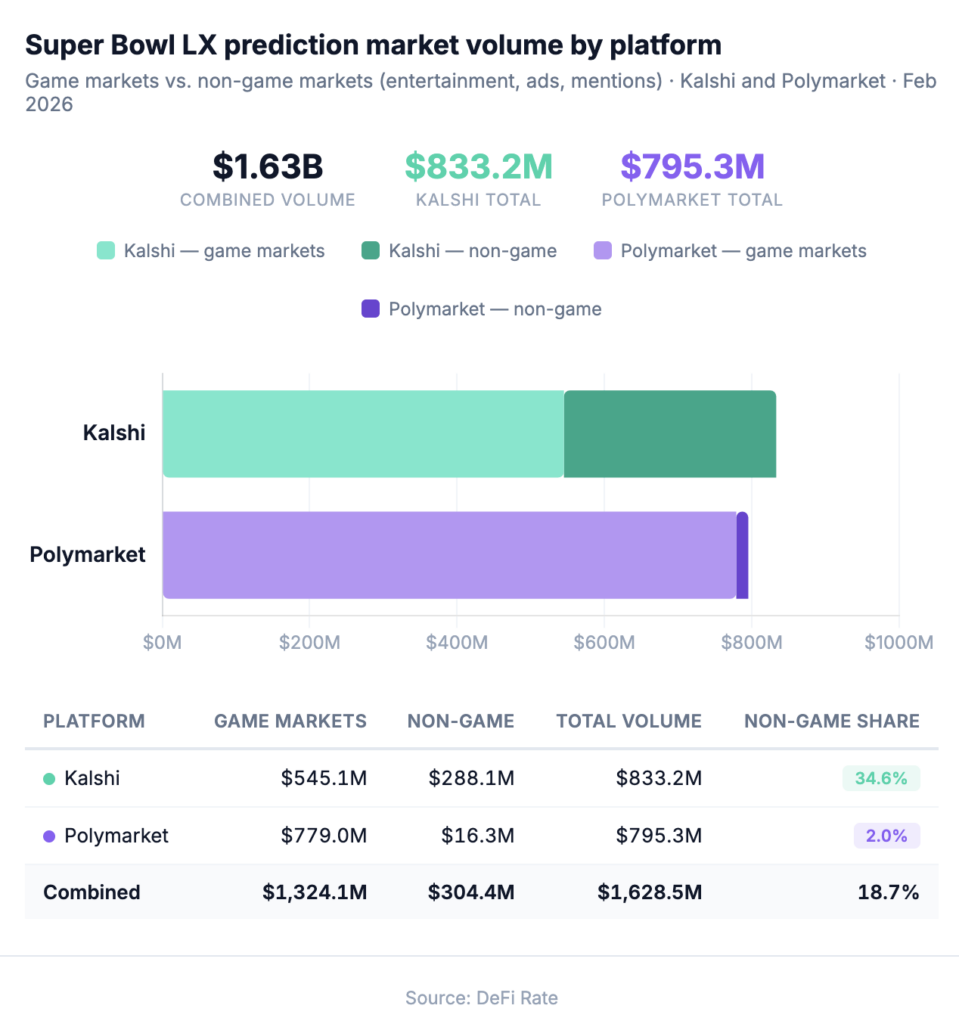

$1.63B in Super Bowl Prediction Market Volume, $304M on Culture: Full Data Breakdown

We tracked $1.63B in Super Bowl prediction market volume across 68+ markets and...

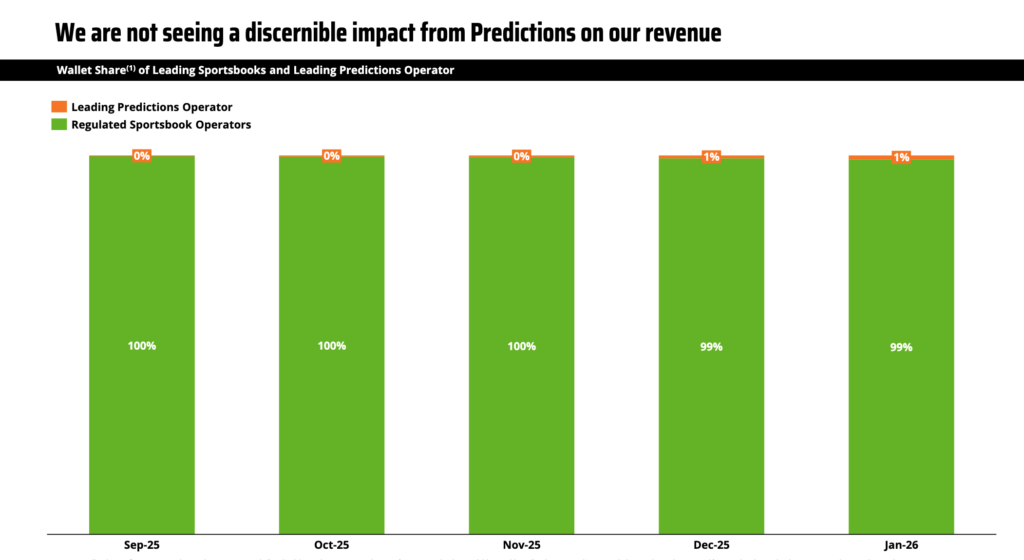

DraftKings Stock Drops 15% on Earnings Miss, Doubles Down on Prediction Markets

In Q4 2025 earnings call, DraftKings CEO confirmed plans to invest heavily in ne...

Rebuilding sUSD

A new path for Synthetix's stablecoinsUSD is the synthetic asset that power...

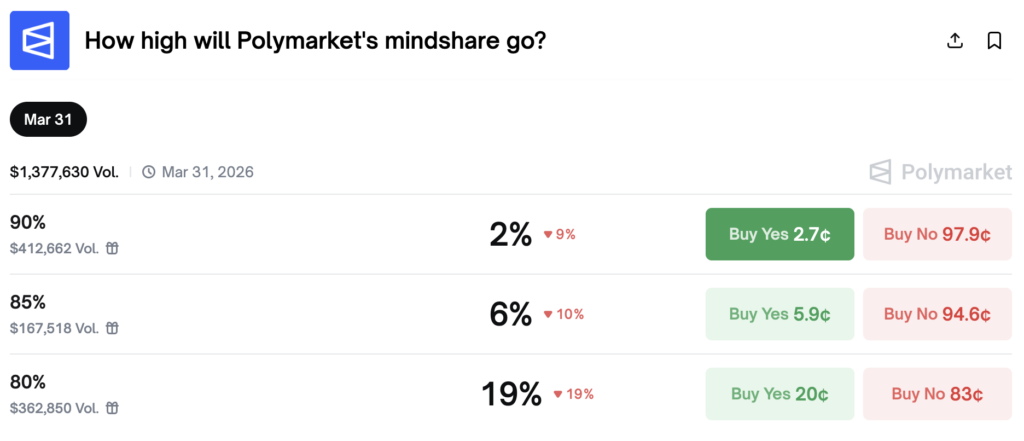

Polymarket and Kaito Roll Out Attention Markets for ‘Mindshare’ Trading: What It Means

Polymarket has two live attention markets on where public sentiment or "mindshar...