BlackRock XRP ETF Next? Canary CEO Eyes Late 2026

Alex Smith

2 weeks ago

Canary Capital CEO Steven McClurg said he expects BlackRock could enter the spot XRP ETF race as soon as late 2026, framing it as a demand-led decision rather than a sudden shift in conviction from the world’s largest asset manager.

Speaking in a Jan. 27 interview with Crypto Sensei, McClurg argued that the market is already moving in that direction as more legacy ETF issuers test the perimeter of non-Bitcoin products.

BlackRock Could Join XRP ETF Race By End Of 2026

“It wouldn’t surprise me if BlackRock files for a XRP, potentially Solana ETF sometime by the end of 2026 or 2027,” he said. “I mean you’ve already got Fidelity, you’ve already got Franklin Templeton in the race there. So it’s not going to be a whole lot longer before BlackRock. Aso […] Invesco just filed for a Solana ETF. Give it time. XRP will be there as well.”

McClurg described the ETF playbook as straightforward: issuers follow client demand and liquid market structure, then expand product shelves once the commercial case is clear. “I think it has to do with a few functions. They want to see demand. They want to see high market cap and it’ll get there eventually,” he said, suggesting that XRP’s pathway to a BlackRock filing is less about narratives and more about sustained investor pull.

That framework also matches how he says Canary thinks about filings. Asked how much product development is driven by client demand versus the firm’s own views, McClurg was blunt: “It’s highly weighted towards where we believe demand is.” He added that Canary will occasionally “take a couple of risks” on earlier-stage tokens, citing Axelar as a filing that was ultimately not launched amid weaker demand and drawdowns.

McClurg’s comments came with a wider thesis about where institutional attention is shifting. He said many pension funds and sovereign wealth investors are approaching Bitcoin as an allocation akin to gold, but that conversations around Ethereum often stall. “The conversation we’re having with Ethereum is that’s old technology, I want what’s next,” he said, adding that some institutions “just pass on Ethereum,” pointing to a view that open-source code can be replicated inside private networks.

By contrast, he said institutions are increasingly focused on networks he described as “very cheap and efficient to run,” naming XRP Ledger, Hedera, and Solana, alongside “competitors to Solana” such as Injective. The core pitch, in his telling, is operational: lower costs, higher throughput, and a clearer line from network utility to enterprise deployment.

On US bank adoption, McClurg predicted banks will partner with specific crypto protocols rather than converge on a single rail, with Ripple “first,” Hedera “second,” and Solana “a far third” in terms of being “dug into the financial system.” He also singled out Ripple’s stablecoin RLUSD as a potential breakout, saying, “I see that thing exploding” once integrated with partner rails, and even floated that RLUSD “could surpass USDC.”

McClurg tied much of the timing, ETFs included, to regulatory clarity. “I don’t really care what’s in the bill. I just want to know what I can and can’t do,” he said, referring to the Clarity Act debate. “And once I know what I can and can’t do, I can go make money […] just tell me the rules so that I can go out and run my business and not have to look over my shoulder.”

At press time, XRP traded at $1.75.

Related Articles

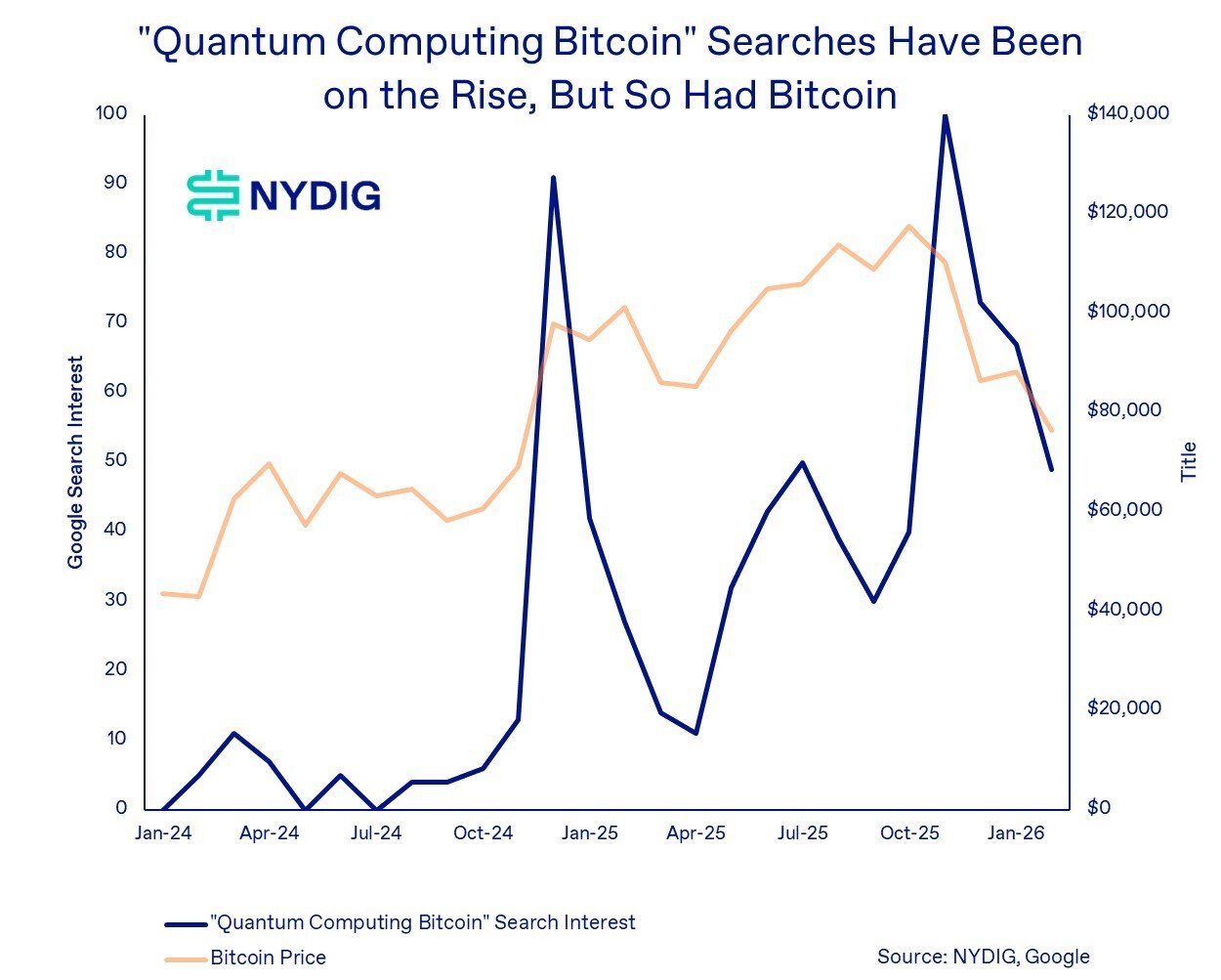

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...

Crypto Watchlist: The Key Catalysts To Track This Week

Crypto’s week is stacked: ETHDenver pulls builders into Denver, a major DAO vote...

Brian Armstrong Praises ‘Diamond Hands’ as Coinbase Reports Strong Retail Activity

Retail investors appear to be holding their ground through the latest wave of cr...