BitMine Loads Up On $98 Million Worth Of ETH As 2025 Winds Down

Alex Smith

1 month ago

According to market reports, BitMine Immersion Technologies acquired roughly $97.6 million worth of Ethereum on Tuesday, buying about 32,938 ETH as investors trimmed positions near the end of the year.

The buy came while prices were subdued, a time some analysts say creates chances for large holders to add to treasuries.

BitMine Adds Millions Of Ether

BitMine’s move was followed by additional activity tied to staking. Reports show the company also staked about 118,944 ETH as part of a plan to earn yield on its holdings.

Those steps pushed public estimates of BitMine’s total Ether holdings to around 4.07 million ETH, with an approximate market value near $12 billion at current prices.

Buying Comes Amid Year-End Selling

2/ Here are our weekly buys by week Weekly ETH buys (by week ending): -12/29/25: 44,463 ETH tokens -12/22/25: 98,852 ETH tokens -12/15/25: 102,259 ETH tokens -12/8/25: 138,452 ETH tokens -12/1/25: 96,798 ETH tokens -11/24/25: 69,822 ETH tokens -11/17/25: 54,156 ETH… pic.twitter.com/80KrtK5uv1

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) December 29, 2025

Based on reports and comments from Fundstrat’s Tom Lee, BitMine timed some purchases to take advantage of what is often called tax-loss selling in the US, which tends to heat up in the final days of the year and can weigh on crypto prices.

Lee said year-end selling—especially from December 26 to December 30—has been a factor pushing certain token prices lower, creating a window for accumulation.

What The Numbers Mean For InvestorsThe scale of BitMine’s accumulation matters because a company holding more than 4 million Ether can influence market perceptions even if it does not trade frequently.

Reports note that BitMine shifted part of its corporate strategy this year toward an Ethereum treasury, and that move has drawn interest from big-name investors and the wider market. The firm’s staking activity also signals a desire to generate returns beyond price gains.

Market Reaction And Wider ContextDifferent methodologies were used to interpret the various trading desk reactions to the institutional purchase of bitcoin. Some trading desks indicated that they thought the purchase showed that the institutional investor community continues to be willing to acquire Bitcoin.

In contrast, other trading desks stated that the year-end volatility and the algorithmic sell-offs are obscuring the true level of interest from these institutions.

The exact amounts and timestamps of the transfers were published via on-chain analytics services, and various crypto media outlets covered the exact same information shortly after the trades were detected on the exchanges.

Featured image from Unsplash, chart from TradingView

Related Articles

If You’re Wondering When The Next Bitcoin Bull Run Will Begin, You Should See This Chart

Market participants continue to search for reliable signals that can define the...

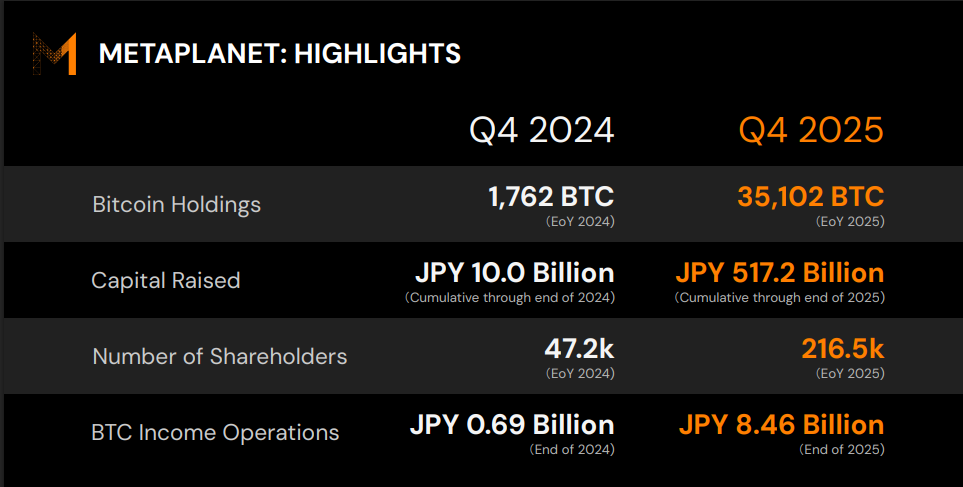

Bitcoin Boost: 95% Of Metaplanet’s Revenue Comes From Crypto

Metaplanet posted a dramatic swing in its latest results after shifting much of...

XRP Dev Predicts Market Cap To Hit $300 Billion Soon, What Would The Price Be?

A new technical projection is circulating in the crypto market after pseudonymou...

Years After NFT Clash, Logan Paul Sells Pokémon Card For Guinness Record $16.5M

YouTube star Logan Paul has turned a pop culture prop into a record. Based on re...