BitMine Buys Over 40,000 ETH As Sell-Off Deepens, Shrugs Off Massive Paper Losses

Alex Smith

5 days ago

BitMine Immersion Technologies kept buying as prices fell, scooping up 40,613 ETH during last week’s sell-off. Reports say the purchase totaled roughly $83–$84 million, made when Ether traded near $2,020 per token.

BitMine’s Growing Stake And The Man At The Helm

According to recent coverage, the move pushed BitMine’s total Ethereum holdings to around 4.32–4.33 million ETH, a stash worth billions at current prices. Executive chairman Tom Lee has framed the dip as an attractive entry point and has voiced confidence in a bounce back.

Paper Losses Widen As Prices Slide

Reports note that the firm’s large cost basis for its accumulated ETH has left its treasury sitting on multibillion-dollar unrealized losses.

Estimates in the latest pieces place those paper losses between about $7.5 billion and $8 billion, depending on which price is used to mark the holdings. That gap widened as Ether fell from higher levels into the low-$2Ks.

Market And Shareholder ResponseBitMine’s aggressive buying did not calm all investors. News outlets tracked a drop in the company’s stock (BMNR), which was reported down roughly 5% in pre-market trading around the same time the ETH buy was disclosed.

Traders appear to be weighing the long-term thesis against the immediate hit to the company’s net asset value.

Why The Company Is Still AddingReports say BitMine sees this as part of an intentional treasury play. Some of the firm’s ETH is staked, which generates yield and can help offset paper losses over time.

Tom Lee has forecast a strong rebound, calling for a V-shaped recovery in ether. That kind of outlook explains why purchases came even while the market was weak.

What To Watch NextShort term, price moves in ether and shifts in investor sentiment will be the clearest signals. If ETH stages a steady climb, the unrealized losses will shrink quickly.

If the token continues to trade lower, the company’s paper loss metrics will remain a headline for shareholders and analysts.

Reports say details such as financing, staking returns, and any further disclosed buys will shape how investors view the firm’s risk profile.

BitMine’s choice to keep buying at lower levels is a clear bet on future price recovery. Whether that bet pays off for shareholders depends on the market’s next moves, and on whether patience and staking income can outweigh a large short-term drawdown.

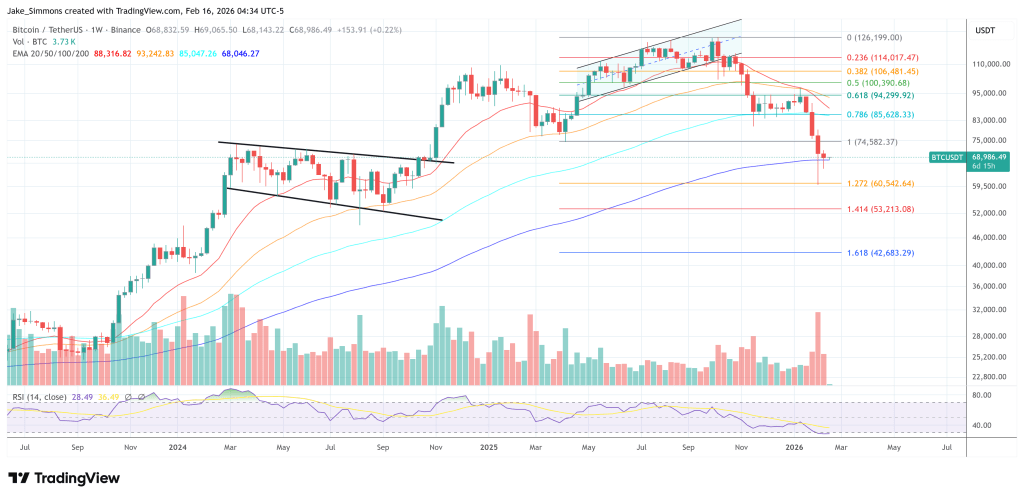

Featured image from Thomas Fuller/SOPA Images/LightRocket via Getty Images, chart from TradingView

Related Articles

Did SBI Holdings Really Buy $10 Billion Worth Of XRP? CEO Reveals The Real Figure

Speculation around institutional XRP accumulation intensified after claims surfa...

Crypto Courtroom Drama: Kevin O’Leary Wins Nearly $3M Against YouTuber ‘Bitboy’

Businessman and TV personality Kevin O’Leary, known as “Mr. Wonderful̶...

Ric Edelman Says $500,000 Bitcoin Is ‘Simple Arithmetic’ By 2030

Ric Edelman says Bitcoin can reach $500,000 by the end of the decade and, unlike...

$129B Crypto Maze: Russian Authorities Lose Sight Of Massive Annual Flows

Russia’s crypto scene is bigger than many realize, and regulators are sounding t...