Bitcoin Social Interest Fades As Retail Chases Gold, Silver Hype

Alex Smith

2 weeks ago

Data shows social media interest has shifted away from Bitcoin and the cryptocurrency sector recently as interest in Gold and Silver has spiked.

Crypto Social Volume Has Cooled Recently

In a new post on X, analytics firm Santiment has talked about how the Social Volume has compared between the cryptocurrency market, Gold, and Silver recently.

The “Social Volume” is an indicator that tells us about the amount of discussion that a given term or topic is receiving on the major social media platforms. It does so by counting up the total number of posts/messages/threads on the platforms that contain unique mentions of the term.

Retail traders outweigh all other types of investors in population, so social media discourse tends to be a reflection of their behavior. As such, a spike in Social Volume for a particular market signals retail interest in the space.

Historically, crypto traders have shifted their attention between various sections like memecoins, AI, blue chips, etc. based on where hype is the greatest. The pattern has changed recently, however, as Santiment has explained, “now, retail is proving to be open to jumping sectors entirely, with social data showing how gold, silver, and even equities are getting more and more interest based on wherever the latest pumps appear.”

Below is the chart for the Social Volume shared by the analytics firm that shows this trend in action.

As displayed in the graph, social media users have seen their attention shift multiple times across January. In the first week, the Social Volume was muted for all markets, corresponding to a post-holidays lull.

During the second week, Gold witnessed its Social Volume shoot high as its price reached new all-time highs. Bitcoin rose alongside this surge, but crypto Social Volume still didn’t budge much.

In the third week, however, social media interest in digital assets saw a return as Bitcoin and other tokens retraced. This activity likely corresponded to traders trying to speculate about the bottom.

Now, in the final week of January, Silver has taken the lead in social media talk, with Gold right behind it and interest in crypto at a low. The shift in retail attention has come as Silver has set new records.

“Remember that when crypto retail begins FOMO’ing in, that’s generally where tops appear,” noted Santiment. This pattern was witnessed during Silver’s latest run to a new all-time high above $117, which was followed by a drop to $103 within hours as retail hype spiked on social media.

With the crypto Social Volume still sitting at relatively low levels, it would appear that the small traders currently don’t feel strongly about Bitcoin and company.

Bitcoin Price

Bitcoin has seen a bearish second half of January as its price has retraced back to $88,000.

Related Articles

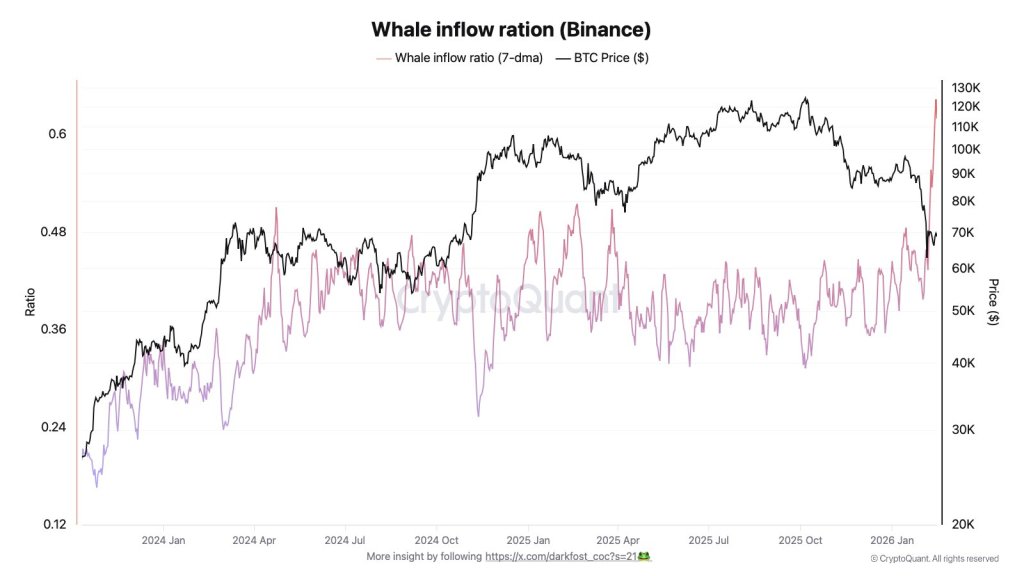

Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venu...

What Bitcoin Rout? Michael Saylor Unfazed, Teases New Accumulation

Strategy has been quietly adding to its Bitcoin pile for the 12th straight week,...

XRP $100 Thesis: Jake Claver Details What Must Happen

Jake Claver is again laying out the conditions he says must line up for XRP to r...

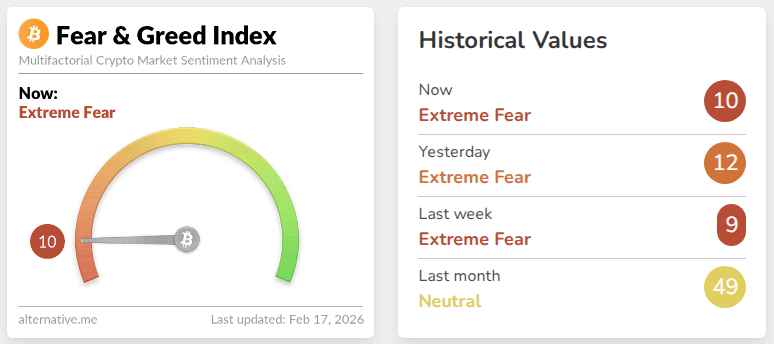

After Extreme Pessimism, Crypto Market Conditions Begin To Stabilize: Analysts

Crypto markets are leaning toward their quietest mood in years, and some analyst...