Bitcoin Fear & Greed Index Nears Neutral As Price Recovers

Alex Smith

1 month ago

Data shows the sentiment among Bitcoin traders has seen a notable improvement recently as the market has gone through a recovery surge.

Bitcoin Fear & Greed Index Is Near The Neutral Zone

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the sentiment that’s held by the average trader in the Bitcoin and wider cryptocurrency markets. It determines the investor mentality using the data of these five factors: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends.

The index uses a numerical scale running from zero to hundred for representing the sentiment. On this scale, all values below 47 correspond to a net sentiment of fear, while those above 53 to one of greed. Levels lying between the two thresholds represent a neutral mentality.

Now, here is how the current Bitcoin sentiment is like, according to the Fear & Greed Index:

As is visible above, the Fear & Greed Index has a value of 42 right now, suggesting a fearful sentiment is shared by the majority. However, the indicator’s value is quite close to the neutral region, so the dominance of fear isn’t too significant. Just a few days ago, this wasn’t the case, as the index was deep into the fear territory.

In fact, the metric’s value was so low that it was inside a special zone called the extreme fear. The turn from extreme fear to the nearly-neutral level of today has come as Bitcoin and other digital assets have enjoyed a recovery rally. Given the trend, it’s possible that if the bullish market push continues, trader sentiment could return to the neutral territory, or even edge slightly into the greed zone.

Historically, cryptocurrencies like Bitcoin have tended to move in the direction that goes contrary to crowd expectations. The probability of an opposite move occurring may be considered the strongest inside the extreme areas of extreme fear (25 and under) and extreme greed (above 75), as they have been where major bottoms and tops have formed in the past. The bottom in November, which has acted as the low for Bitcoin so far, also formed when the market held a sentiment of extreme fear.

Now that the Fear & Greed Index has edged to the neutral zone, though, sentiment may not be able to dictate where the market will head next, since traders currently don’t agree on a direction. In such an environment, the chances of a move occurring in either direction may be equally probable.

BTC Price

Bitcoin broke above $94,000 earlier in the week, but its price has seen a setback as it’s now back at $92,000.

Related Articles

$274 Billion In Potential Bitcoin Selling Could Hit Markets, Expert Says

While much of the market’s attention remains fixed on the Bitcoin (BTC) short-te...

XRP Price Signals Potential Upside Reversal After Prolonged Weakness

XRP price extended losses and traded below $1.450. The price is now consolidatin...

Bitcoin Miners Pull 36K BTC From Exchanges In Weeks: What Comes Next?

Bitcoin continues to struggle to reclaim the $70,000 level, with price action in...

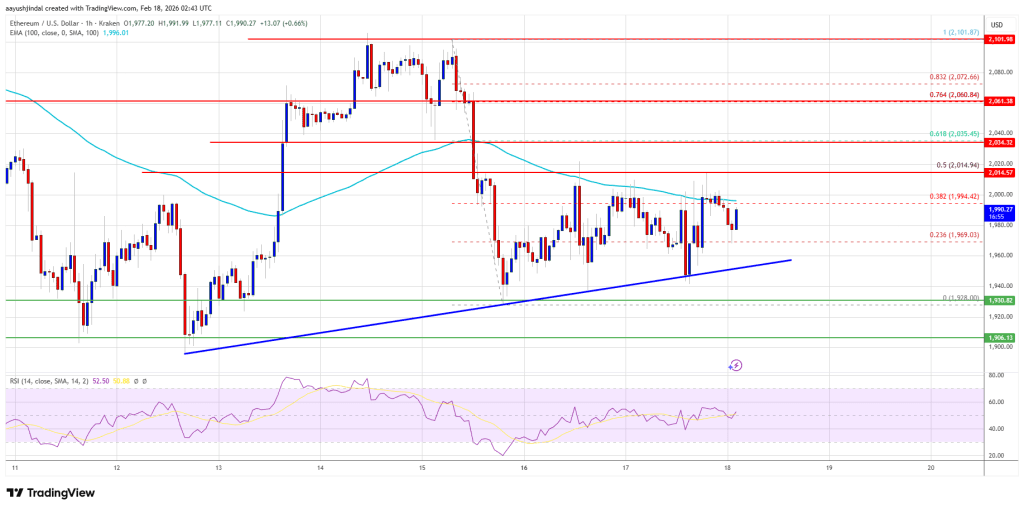

Ethereum Price Anchors At $1,920 — Can Bulls Ignite A Fresh Upside Leg?

Ethereum price found support near $1,920 and recovered some losses. ETH is now c...