Bitcoin Decouples From Global Liquidity: Analyst Says Quantum Threat Behind It

Alex Smith

1 month ago

Bitcoin has decoupled from the global M2 supply for the first time. Here’s what could be the reason for it, according to the founder of Capriole Investments.

Bitcoin Has Diverged From The Global M2 Supply Trend

In a new post on X, Capriole Investments founder Charles Edwards has talked about how Bitcoin has decoupled from the global liquidity flows recently. Below is the chart cited by Edwards, which compares the year-over-year (YoY) percentage change in BTC to that in the global M2 supply.

As displayed in the graph, Bitcoin’s YoY change flatlined over 2025 while the total money supply of the world’s major economies witnessed growth, indicating BTC diverged from traditional liquidity flows.

In the past, the cryptocurrency’s YoY percentage change has generally showcased a similar trajectory to the global M2 supply. “This is the first time Bitcoin has decoupled from money supply and global liquidity flows,” noted the analyst.

What’s the reason behind this new trend? According to Edwards, it’s the threat posed by quantum computing to the network. Quantum computers are hypothesized to have the capability to break the cryptocurrency’s cryptography, with wallets from the blockchain’s early days being especially vulnerable.

It’s uncertain when quantum machines will find a breakthrough, but the Capriole founder believes BTC passed into a “Quantum Event Horizon” in 2025. “The timeframe to a non-zero probability of a quantum machine breaking Bitcoin’s cryptography is now less than the estimated time it will take to upgrade Bitcoin,” said Edwards.

In theory, a party with a sufficiently advanced quantum computer could break into old dormant wallets and dump the coins on the market. This would not only directly impact BTC’s price but could also undermine broader trust in the cryptocurrency itself.

“Money is repositioning to account for this risk accordingly,” explained the analyst. One X user countered that most investors don’t seem to agree with Edwards’ quantum timeline, suggesting that the market would be unlikely to decouple based on a view not widely shared.

“If you listen to all in bitcoin maxis on X you would think that,” Edwards replied to the user. “If you talk to real capital allocators and Bitcoin OGs in the space 7+ years in private – they are all considering this risk.”

In some other news, Bitcoin spot exchange-traded funds (ETFs) have continued to face weak demand recently, as data from SoSoValue shows.

From the above chart, it’s visible that last week saw $681 million exit from the US Bitcoin spot ETFs. The new week has started with inflows so far, but it only remains to be seen whether they will continue in the coming days.

BTC Price

At the time of writing, Bitcoin is floating around $92,100, up nearly 2% in the last 24 hours.

Related Articles

$274 Billion In Potential Bitcoin Selling Could Hit Markets, Expert Says

While much of the market’s attention remains fixed on the Bitcoin (BTC) short-te...

XRP Price Signals Potential Upside Reversal After Prolonged Weakness

XRP price extended losses and traded below $1.450. The price is now consolidatin...

Bitcoin Miners Pull 36K BTC From Exchanges In Weeks: What Comes Next?

Bitcoin continues to struggle to reclaim the $70,000 level, with price action in...

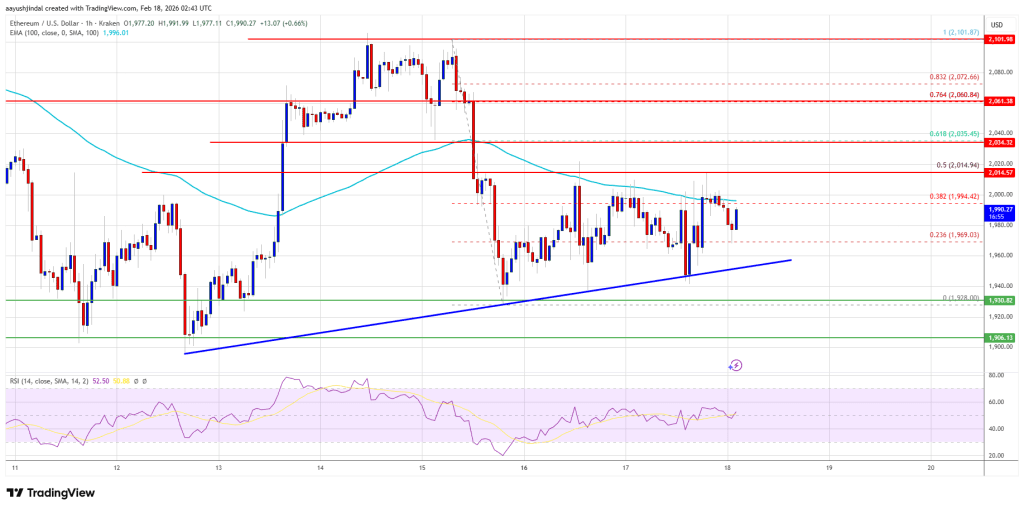

Ethereum Price Anchors At $1,920 — Can Bulls Ignite A Fresh Upside Leg?

Ethereum price found support near $1,920 and recovered some losses. ETH is now c...