Bitcoin Could Be Setting Up A Comeback Vs. Gold, Analyst Suggests

Alex Smith

1 month ago

A veteran market analyst has flagged a technical pattern that could signal a turning point for Bitcoin after months of underperformance versus gold. The move comes as traders weigh whether the long run of gains for the yellow metal has exposed limits in Bitcoin’s safe-haven story.

Bitcoin Versus Gold Ratio Down

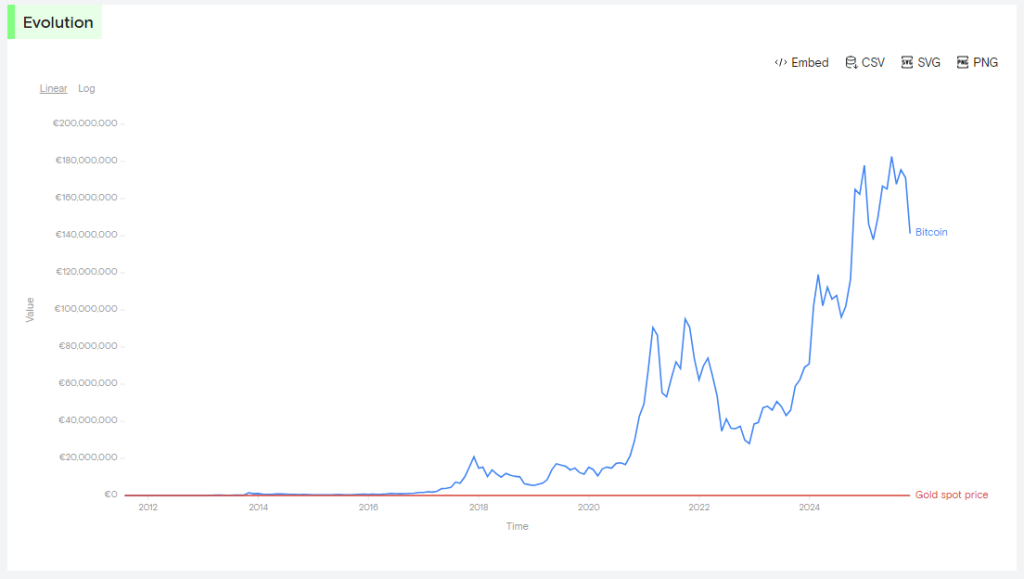

The Bitcoin-to-gold ratio has plunged. It fell from 32 on Oct. 5 to about 20 today, a drop of more than 37%. According to the data, that means one Bitcoin bought roughly 32 ounces of gold in early October but now buys about 20. The ratio’s slide has accelerated since gold’s rally took hold and Bitcoin’s price slipped below key levels.

Daily readings point to a possible change in momentum. On Nov. 21 the BTC/GOLD pair hit a low of 20 and the RSI stood at 21.30. A lower low near Dec. 1 came with a higher RSI low of 26.83. Then another trough at 19 on Dec. 26 coincided with a higher RSI low of 32.21.

That’s a valid bullish divergence on the daily timeframe for BTCUSD vs. Gold.

Interested to see where that leads us into 2026. pic.twitter.com/D6ei8HsIDy

— Michaël van de Poppe (@CryptoMichNL) December 31, 2025

Based on reports, Michaël van de Poppe called this pattern a “strong” bullish divergence on the daily chart, a setup traders watch because it can show selling pressure easing even as prices make new lows.

Technical Signals Show Cooling Selling Pressure

On the weekly chart the picture adds weight to the signal. The weekly RSI for the BTC/GOLD pair has sunk to about 31.85 at press time. That level was last seen during the November 2022 sell-off tied to the FTX collapse, a point that marked a bottom in that cycle.

Reports also link similar RSI lows to the bottoms seen in 2015 and 2018. Taken together, the daily divergence and the low weekly RSI make a stronger case that the downtrend may be losing steam, though nothing is guaranteed.

Market Sentiment Splits InvestorsGold’s rally has been dramatic. Reports show gold surged by over 70% in 2025 while Bitcoin fell by 7% over the year in some measures. At press time Bitcoin trades at $87,750, down 4.8% year-to-date.

The breakdown in the Bitcoin-to-gold ratio and Bitcoin’s continued weakness below $100,000 have prompted fresh questions about the “digital gold” story as bullion posts historic gains.

Short-term money appears to favor gold for capital protection. Many traders are treating the metal as a shelter while it climbs to new highs. Long-term holders, however, still point to Bitcoin’s potential for big upside once risk appetite returns.

According to market watchers, the near-term outlook hinges on whether the BTC/GOLD ratio and price action deliver follow-through above key levels. Until that happens, signals will remain tentative.

Featured image from Unsplash, chart from TradingView

Related Articles

Solana ETFs Attract $31M While Crypto Funds Lose $173M, Is SOL Gearing for a Possible Rally

While digital asset funds recorded significant capital outflows for a fourth con...

This Ethereum Hidden Bull Divergence Says Price Will Rise Over 100% To Break $4,900 ATH

Crypto analyst Javon Marks has revealed how Ethereum could recover and possibly...

DOGE Price Slips 3% Daily, Break Below $0.098 Could Trigger Further Dogecoin Downside

Dogecoin (DOGE) is currently testing investor confidence as the memecoin hovers...

Dogecoin Has Now Broken Out Of A Descending Triangle, Here’s The Next Stop

Dogecoin might be trading at $0.1, but is already flashing signs of a structural...