Binance Plans Gradual Conversion Of $1 Billion SAFU Fund Into Bitcoin

Alex Smith

2 weeks ago

As Bitcoin (BTC) struggles through a prolonged downturn, cryptocurrency exchange Binance has unveiled a new move aimed at reinforcing confidence in the digital asset sector. Amid this, BTC has fallen 34% over the past four months, a slide that has fueled growing debate over whether the market has entered a new bear phase.

Against that backdrop of heightened uncertainty, Binance said it intends to take concrete steps to support the broader crypto ecosystem rather than retreat during market stress.

Binance Overhauls SAFU Fund

In an open letter released to the community on Friday, Binance reiterated its view that Bitcoin remains the foundational asset of the crypto market and a store of long‑term value, regardless of short‑term price swings.

Based on that conviction, the company announced plans to overhaul the composition of its Secure Asset Fund for Users (SAFU). Binance said it will convert the SAFU fund’s existing $1 billion reserves, currently held in stablecoins, into Bitcoin.

The conversion is expected to be completed within 30 days of the announcement. Going forward, the exchange plans to actively rebalance the fund by monitoring its market value.

If fluctuations in Bitcoin’s price cause the SAFU fund to fall below $800 million, Binance said it will step in to replenish the balance and restore the fund’s value to $1 billion.

According to the exchange, the decision forms part of a broader, long‑term strategy to continue investing resources into the crypto industry through both favorable and challenging market conditions.

2025 Protection Metrics

In the same letter, Binance highlighted a series of initiatives it carried out in 2025 to support users, strengthen compliance, and contribute to ecosystem development.

The company said it assisted users in recovering funds from nearly 38,648 cases of incorrect deposits during the year, returning a total of $48 million. Cumulatively, Binance noted that it has helped users recover more than $1.09 billion to date.

On the risk management front, the exchange reported that it helped 5.4 million users identify potential threats in 2025, preventing an estimated $6.69 billion in losses tied to scams.

Binance also pointed to its cooperation with global law enforcement agencies, which it said resulted in the seizure of approximately $131 million in illegally obtained funds.

On transparency, Binance said that by the end of 2025, its proof‑of‑reserves showed user assets totaling about $162.8 billion, fully backed across 45 different crypto assets.

In closing, the exchange said it plans to continue addressing market concerns through tangible actions, maintaining a focus on openness, transparency, and long‑term participation in industry development.

As of this writing, BTC is trading at $83,336, marking an 8% decline over the past week. Similarly, Binance Coin (BNB), the exchange’s native token, has dropped 5% during the same period and is currently hovering at around $848 per token.

Featured image from OpenArt, chart from TradingView.com

Related Articles

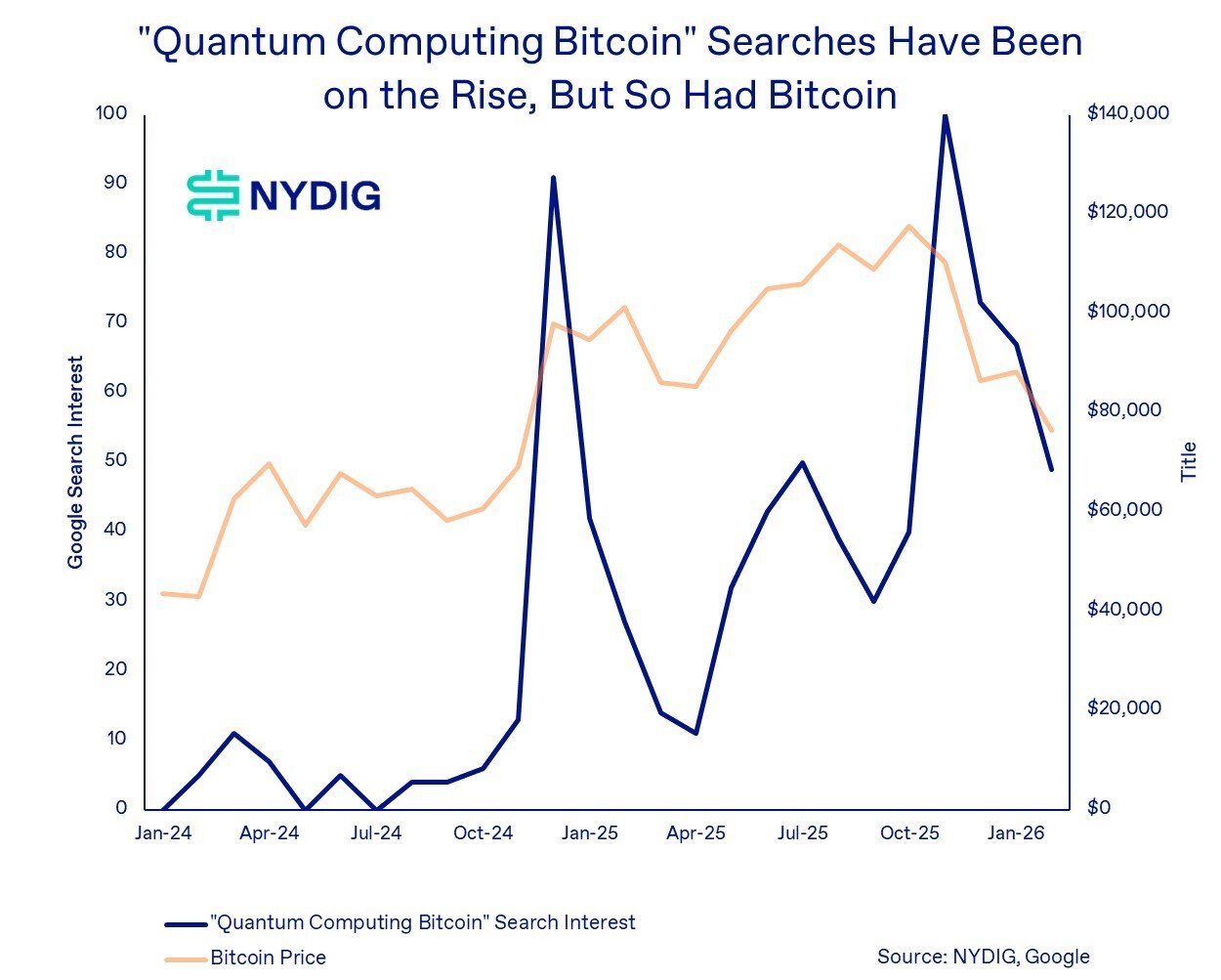

Quantum Threat Behind Bitcoin’s Decline? Analyst Points To Google Search Data

The founder of Capriole Investments has pointed out how Google searches related...

Bitcoin Drops to $68K Amid Four-Week Slide, but Bullish Divergence Hints at $71K Test

Bitcoin’s (BTC) latest attempt to stabilize has left traders divided. After brie...

Crypto Watchlist: The Key Catalysts To Track This Week

Crypto’s week is stacked: ETHDenver pulls builders into Denver, a major DAO vote...

Brian Armstrong Praises ‘Diamond Hands’ as Coinbase Reports Strong Retail Activity

Retail investors appear to be holding their ground through the latest wave of cr...